Last Week’s Markets in Review: Forward Expectations Push Stocks to New Highs

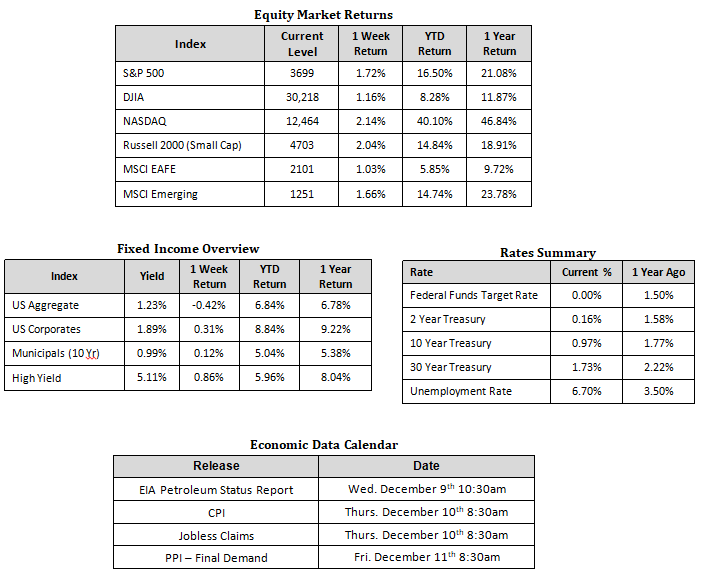

Global equity markets experienced another positive week, with U.S. stocks leading the way. In the U.S., the S&P 500 Index fell to a level of 3,699, representing a 1.72% gain, while the Russell Midcap Index pushed 2.03% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.04% over the week. Moreover, developed and emerging international markets returned 1.03% and 1.66%, respectively. Finally, the 10-year U.S. Treasury rose to 0.97%, 13 basis points higher than the prior week.

On the economic data front, investors watched jobless claims figures closely to see if the last two weeks’ troubling pattern of rising claims would persist. Fortunately, the trend reversed course as 712,000 filed new unemployment claims, well below the 780,000 that had been expected. Moreover, unemployment data showed that 6.7% of the American workforce remains out of work, decreasing from last month’s figure of 6.9%. While we won’t celebrate the fact that roughly 7% of the country’s labor force remain out of work, we can at least recognize that this is an incredible improvement from the 15% unemployment levels witnessed earlier in the year and substantially lower than most had expected it to be by year-end. On the flip side, new job creations in November fell well-short of expectations as 245,000 new jobs were created versus consensus expectations looking for around 460,000 new job creations. Net new job creations of any magnitude for a month are certainly a positive for the U.S. economy, but this now marks the fifth consecutive month of a slowdown in the pace of job creations.

With economic data, particularly jobless claims, showing signs of weakness over the two weeks before this past week, many investors have been asking how the Dow Jones Industrial Average, S&P 500, and the NASDAQ can simultaneously push to new all-time highs. If backward-looking economic data appears to be worsening, wouldn’t stock markets move lower rather than rocket to new highs? This is an entirely reasonable question and one that investors were also asking when stocks rallied off of recession lows in April, all while the pace of the economic recovery was even more precarious than it is now (although uncertainty remains high).

The simple answer is that stock markets have typically shown indifference toward what has already happened and primarily responds to what most expect will happen in the future. To this end, the U.S. stock market is viewed by many as an economic indicator that typically leads economic growth by approximately six months or longer. This concept can essentially be summarized by the adage, “buy on the rumor, and sell on the news.” As such, it’s natural to see stock markets rally on the assumption that the economy will be on firm footing six months (or more) in the future, even if current economic conditions appear less than ideal. For supporting evidence of this relationship, we can look to a recent Goldman Sachs report, which estimates that U.S. corporate earnings will return to pre-pandemic levels by mid-2021. Accepting recent new all-time highs made by most major stock market indexes as justified and well-founded becomes much more palatable when we begin to consider that corporate profits are expected to return to pre-pandemic levels only six months in the future.

Nonetheless, it’s crucial to keep in mind that forward expectations are ever-changing, and there is always the potential for a downside surprise. This past week British regulators granted emergency approval allowing for the distribution of the Pfizer/BioNTech COVID-19 vaccine to all citizens of the United Kingdom (U.K.). This news which will likely increase GDP and corporate profit expectations for the U.K. and its corporations. But, again, future developments could always surprise to the downside, which is why we continue to advocate for balance and diversification within investment portfolio strategies where possible. For this reason, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, timeframe, and tolerance for risk.

We recognize that these are very troubling and uncertain times, and we want you to know that we are always here to help in any way we can. Please stay safe and stay well.

Other Data Sources: Equity Market and Fixed Income returns are from JP Morgan as of 12/4/20. Rates and Economic Calendar Data from Bloomberg as of 12/4/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology. S&P 500 sector performance represents total return figures sourced from Bloomberg.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.