Last Week’s Markets in Review: GDP and PCE Data Stun Hopes of a Santa Clause Rally

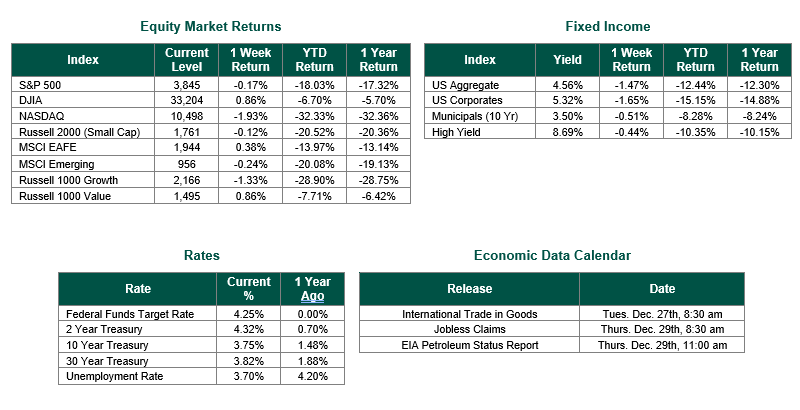

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,845, representing a decrease of 0.17%, while the Russell Midcap Index moved 0.07% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.12% over the week. As developed, international equity performance and emerging markets were mixed, returning 0.38% and -0.24%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.75%.

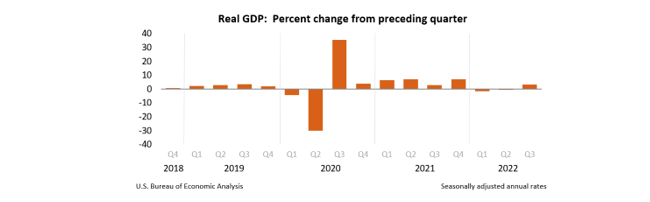

Just one day after U.S. markets reported strong consumer confidence figures while simultaneously getting strong corporate earnings figures from companies such as Nike and FedEx, the third estimate of 3rd quarter U.S. real gross domestic product (GDP) delivered on Thursday indicated an increased annual growth rate of 3.2%. With the third revision beating both consensus expectations and the second revision of 2.9% on a year-over-year basis, the strength of the U.S. economy does not appear to be wavering yet as a result of the high-interest rates the Federal Reserve has put into effect over the course of this year.

Typically, stronger-than-expected economic growth would be heralded by markets. However, in this unique market period, concerns over monetary policy strength and threats of more rate hikes would push markets in the opposite direction. Perhaps the market’s reaction over the past week is justified, with Core-PCE, the Fed’s preferred measure on inflation, being hotter than expected at 0.3%, above expectations of 0.2% in November and 4.7% higher on a year-over-year basis. As was discussed on CNBC earlier this week, despite the positive confidence in markets and strong earnings figures, the combined impact of these data releases might prevent a Santa Clause rally or, perhaps, Santa Clause arrived earlier this year than in years past.

Happy Holidays, everyone, and best wishes for the week ahead!

GDP and Personal Consumption Expenditures data sourced from the U.S. Bureau of Economic Analysis on 12/22/22. Equity Market and Fixed Income returns are from JP Morgan as of 12/23/22. Rates and Economic Calendar Data from Bloomberg as of 12/23/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.