Last Week’s Markets in Review: High Rates Reverberate Through Markets

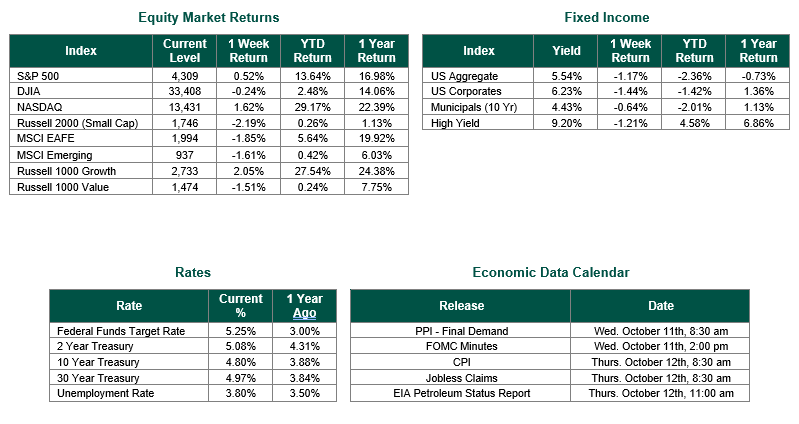

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 4309, representing a gain of 0.52%, while the Russell Midcap Index moved -0.93% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.19% over the week. As developed international equity performance and emerging markets were lower, returning -1.85% and -1.61%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.80%.

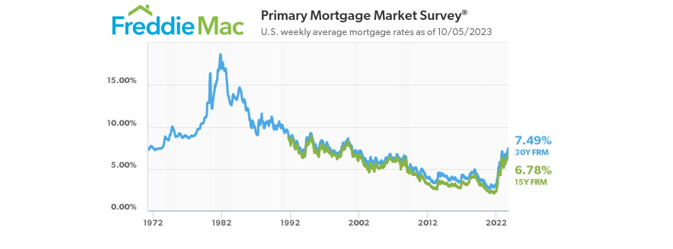

The yield on 10-year U.S Treasuries hit a 16 year high during the past week, reaching a level of 4.88% following a hawkish outlook from the Federal Reserve and rising concerns over U.S. government deficit spending. The rise in U.S. Treasury yields has sent shockwaves across markets. Funding costs from borrowers have risen dramatically, most notably within the housing market where the current 30-year fixed rate mortgage sits at 7.49%, according to Freddie Mac – the highest level since 2000! Equities have also suffered from the rise in yields as tighter financial conditions raise the cost of capital for many corporations.

The sharp rise in yields was fueled further on Friday when non-farm payroll figures came in nearly twice as high as consensus expectations. According to the Department of Labor, 336,000 jobs were added in September, substantially ahead of the 170,000 Dow Jones estimate and more than 100,000 higher than the August reading. The greater than expected jobs figures did not have much of an influence on the outlook for the Fed’s interest rate expectations through the end of 2023. However, it has likely increased the probability that the beginning of rate cuts would be pushed further out into the future. The longer that rates remain at these elevated levels, the greater the impact they will have on constraining the U.S. economy.

Whether your portfolio is positioned in equities, bonds, real estate, or other alternative asset classes, interest rates have, and will continue to have, an impact on their respective values. For these reasons, we suggest working with investment professionals to ensure that your portfolio is positioned in accordance to your goals, objectives, risk tolerance, and time horizon. We also believe it to be prudent to work with an advisor to review your current portfolio and discuss how high interest rates may be effecting your financial picture.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 10/6/23. Economic Calendar Data from Econoday as of 10/6/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.