Last Week’s Markets in Review: Hotter Inflation May Delay First Rate Cut

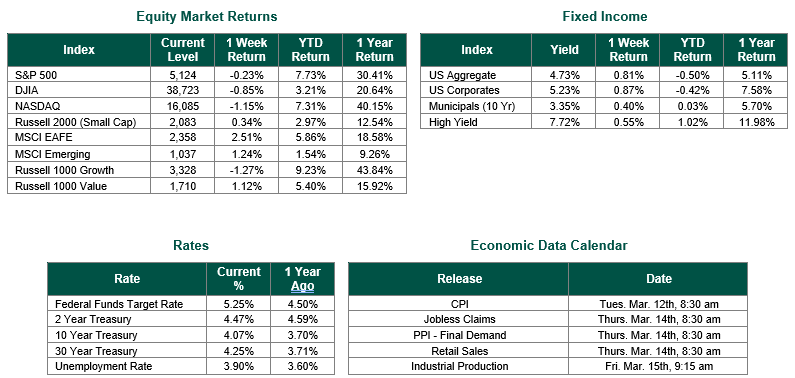

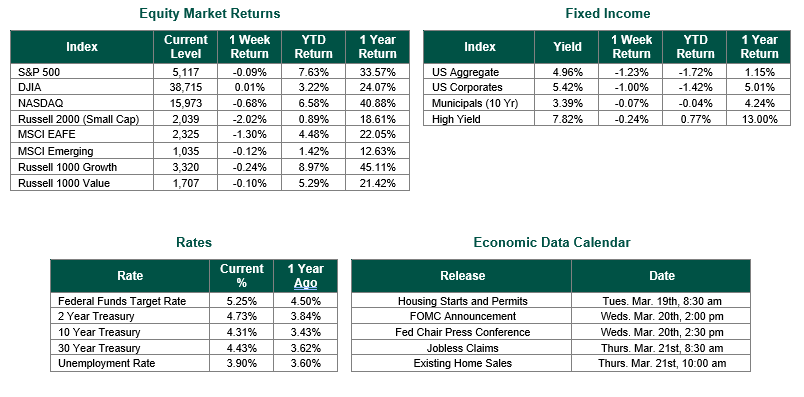

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,177, representing a decrease of 0.09%, while the Russell Midcap Index moved -0.01% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.02% over the Week. As developed international equity performance and emerging markets were lower, returning -1.30% and -0.12%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.31%.

As has been the case for the past 18 months, inflation data was the focus of market participants last week. Inflation has been the driving force for the Fed’s monetary policy throughout this period. On Tuesday, the Bureau of Labor Statistics (BLS) released the February Consumer Price Index (CPI). CPI is a broad measure of the costs of goods and services. The index increased 0.4% for the month and 3.2% from a year ago. The monthly gain met the consensus estimate, but the annual rate was slightly ahead of the 3.1% consensus forecast. Excluding volatile food and energy prices, the core CPI rose 0.4% monthly and was up 3.8% year-over-year. Both measures were 0.1% higher than their forecasts. A 2.3% increase in energy costs helped boost the headline inflation number. Food costs were flat during the month, while shelter costs rose by another 0.4%. While the 12-month pace is off the inflation peak reached in mid-2022, it remains well above the Fed’s 2% inflation target, though it should be pointed out that the Fed’s preferred inflation gauge is the Personal Consumption Expenditures Price Index (PCE), not CPI.

This data was the last inflation information the Fed will receive before its two-day Federal Open Market Committee (FOMC) meeting beginning on March 19th. The overwhelming opinion is that the Fed will not change the Fed Funds Target Rate from its current range of 5.25% – 5.50%. Utilizing the CME FedWatch Tool as a measure of the latest probabilities of rate moves, there is a 99% probability of no rate change. The February CPI data did not affect this measure, as the probability stood at 98% before the release of February’s CPI. On the other hand, the February CPI data moved the probability of the first Fed rate cut further into 2024. The CME FedWatch Tool does not show a greater than 50% probability of a rate cut until the June FOMC meeting. We believe the Fed will be cautious in cutting rates until they get inflation closer to their stated goal of 2%, provided their forecasted economic slowdown does not dip into recessionary territory. We contend that the Fed will most likely consider cutting rates at their July meeting.

While there is not likely to be a policy change at this week’s Fed meeting, there will be a press conference for Chairman Powell and the release of updates on the Fed’s Summary of Economic Projections and Dot Plot chart. The market will parse these updates and every statement the Chairman makes to help determine the exact nature of the Fed’s future monetary policy.

Best wishes for the week ahead, and happy belated St. Patrick’s Day to everyone!

The Consumer Price Index is sourced from the Bureau of Labor Statistics. Economic Calendar Data from Econoday as of 3/18/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.