Last Week’s Markets in Review: How Much Longer will the Consumer Spend?

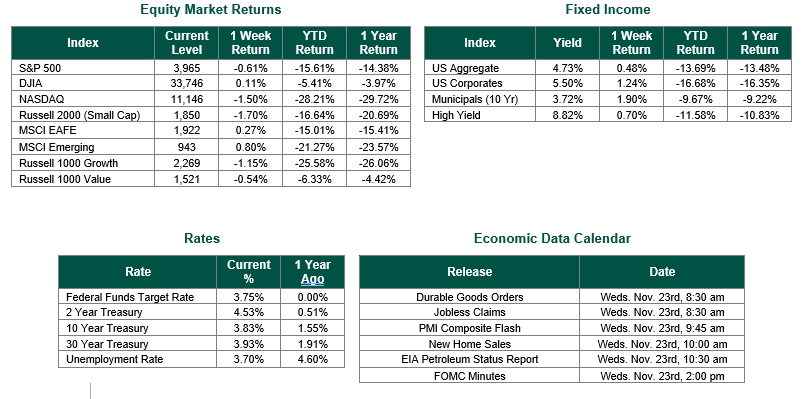

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,965, representing a decrease of 0.61%, while the Russell Midcap Index moved -1.37% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.70% over the week. As developed, international equity performance and emerging markets were higher returning 0.27% and 0.80%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly higher, closing the week at 3.83%.

The past week saw trading sessions where the major equity indexes were volatile but essentially range bound. The volatility was in response to the release of economic data related to the current level of inflation and comments made by several Federal Reserve officials. Throughout the remainder of this update, we will provide our readers with the details of these economic reports and Federal Reserve comments.

On Tuesday, the Bureau of Labor Statistics (BLS) released October’s Producer Price Index (PPI). The index, which measures changes in the prices paid to U.S. producers of goods and services, rose 0.2% for the month, compared to the consensus estimate for an increase of 0.4%. On a year-over-year basis, PPI rose 8.0% compared to an annual increase of 8.4% in the prior month. Wholesale prices rising less than expected, on top of the better-than-expected Consumer Price Index (CPI) results from the preceding week, added to the hopes that inflation may be starting to moderate.

The Commerce Department reported on October retail sales last Wednesday. Retail sales rose 1.3% last month after being unchanged during the month of September. The consensus estimate was for a rise of 1.0%, suggesting that consumers continue to spend despite persistently high inflation levels. It should be pointed out credit card balances collectively rose more than 15% from the third quarter of 2021, representing the largest annual jump in more than 20 years, according to the New York Fed. In addition, the national personal savings rate is down to a miserly 3.7%, representing its lowest level since 2008 and less than half the rate before the pandemic. As a result, it would seem reasonable to question how much longer the consumer will continue to spend and if holiday shopping sales will be impacted. Consumer spending is critical to the U.S. economy as it accounts for approximately 70% of gross domestic product (GDP).

Last week’s final economic data report related to the employment market showed that initial jobless claims fell by 4,000 to 222,000 total claims. This total was below consensus expectations looking for 228,000 new jobless claims.

With the data reported during the week creating a market sentiment that pointed to a perceived turning point in Fed policy, several Fed Officials decided to reiterate their stance that they will continue to raise interest rates to battle historically high inflation. For example, St. Louis Federal Reserve President James Bullard stated that the Fed still has a lot of work to do before it brings inflation under control. Bullard said, “To attain a sufficiently restrictive level, the policy rate will need to be increased further.”

The next scheduled Federal Open Market Committee (FOMC) meeting is December 14th. According to the CME Fed Watch Tool, there is an 80.6% chance of a 50 Basis Point (0.50%) rate hike following the December FOMC meeting.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead, and Happy Thanksgiving to all!

The Producer Price Index is sourced from the Bureau of Labor Statistics. Retail Sales data is sourced from the Commerce Department. Weekly Jobless Claims were sourced from the Department of Labor. Equity Market and Fixed Income returns are from JP Morgan as of 11/18/22. Rates and Economic Calendar Data from Bloomberg as of 11/18/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.