Last Week’s Markets in Review: Inflation Deceleration

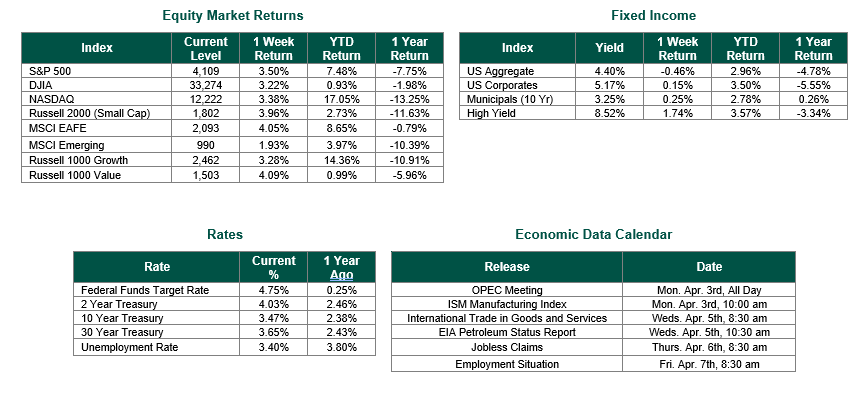

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,109, representing an increase of 3.50%, while the Russell Midcap Index moved 4.11% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.96% over the week. As developed, international equity performance and emerging markets were higher, returning 4.05% and 1.93%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.47%.

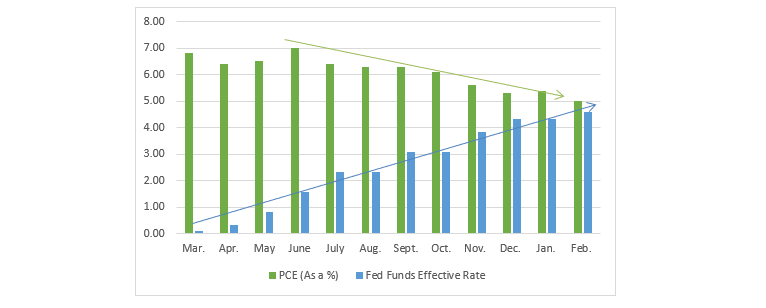

Just over a week after the Federal Reserve decided to increase the Federal Funds Target Rate by 0.25%, economic data showed a deceleration in the Fed’s key inflation measuring tool, Personal Consumption Expenditures (PCE). Although not a drastic move, the figure showed a 0.3% month-over-month increase and a 5.0% year-over-year increase, both of which were 0.1% below consensus expectations. The softer-than-expected data came with monthly energy prices decreasing 0.4% while food prices rose 0.2%. Goods prices rose 0.2%, while services increased 0.3%. Other data from the report showed personal income increased by 0.3%, slightly above the 0.2% estimate. Consumer spending also rose 0.2%, compared to the 0.3% estimate.

During their meeting on the week of February 20, Jerome Powell referenced a target inflation rate of 2% in 2024. While Friday’s release is still 3.00% away from that target, it is still a step in the right direction that market participants and economists have been hoping for as a byproduct of the aggressive monetary tightening policies put in place over the past year.

Concurrently last week, the third revision to the 4th Quarter 2022 GDP showed a slight reduction from prior estimates. The 2.6% figure would be a 0.1% drop from what was previously measured and expected based on consensus expectations. The market did not put much weight into the revision as the S&P 500 opened higher on the day of the update and never wavered. With the first quarter of 2023 now behind us, investors will now focus on Q1 2023 GDP, which will be released on April 27. Investors will gauge the health of the U.S. economy and have a better indication as to whether there may be a recession on the horizon. The Fed is not scheduled to meet again until early May. At that point, the optimistic inflation data may give the committee enough cover to stop raising rates altogether following their recent, potentially final, increase of this rate hike cycle.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

PCE and GDP date from the Bureau of Economic Analysis on 3/31/23 and 3/30/23, respectively. Effective Fed Funds Rate information from the Federal Reserve Bank of New York on 3/31/23. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 3/31/23. Economic Calendar Data from Econoday as of 3/31/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.