Last Week’s Markets in Review: Inflation Puts Bonds in Uncharted Territory

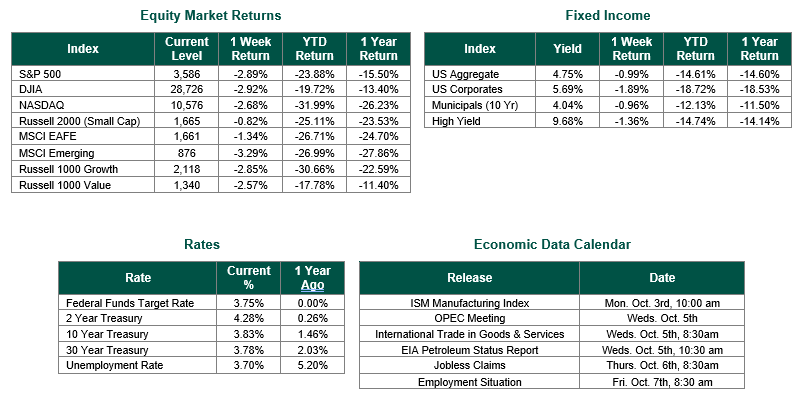

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,586, representing a decrease of 2.89%, while the Russell Midcap Index moved 1.67% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.82% over the week. As developed, international equity performance and emerging markets were lower returning -1.34% and -3.29%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.83%.

The third quarter is now behind us and while it appeared the market was going to rebound off its abysmal Q2, all major indices would ultimately finish lower. The third revision to second-quarter gross domestic product (GDP) was unchanged at -0.6%, the jobs market continues to be resilient with the latest jobless claims number coming in 22,000 (below consensus), and inflation continues to run rampant with Core Personal Consumption Expenditures (PCE), which is the Federal Reserve’s preferred gauge of inflation, not only showing an increase on a year-over-year basis of 4.9% (above expectations of 4.8%), but also an increase over the previous reading’s level of 4.7%. The Federal Reserve continues to be motivated to put an end to the inflationary pressures, even if it may come at the expense of an economic recession. Beyond the mostly negative data reported in this past week, there does appear to be certain abnormalities in today’s market, one of which we will highlight in this week’s update.

Typically, the correlations between stock market returns and bond prices are inversely related. As equity markets are in growth stages, bond prices will fall or lag behind stocks as investors do not exhibit a demand for safety. On the other hand, when equity markets retract, and concerns about growth exist, the demand for safety provided by bonds will typically cause a rise in prices as stocks fall. This is different from what is happening in today’s market. Consider the chart below. Here we have 25 years of returns for both the S&P 500 index ($SPXTR) and the Barclays US Treasury 20+ Year index (identifying long-term government bonds) ($BCTB15). Not only are the prices of these indices moving in conjunction negatively, but it is also the only time in this reported history that treasury bond prices are declining by more than equities when they are not trading inversely. This is indeed a remarkable event and one that shows the strong negative effect that inflation is having on our markets. As it appears, with nominal returns of treasuries, even on the long end of the yield curve, drastically trailing inflation (and the Fed Fund Target Rate for that matter) is being discounted more than the risk associated with equities-oriented style investments.

Source: Kwanti Portfolio Analytics

Perhaps this abnormality is a function of an oversold U.S. Treasuries market, and if we have reached peak inflation and hawkishness from the Fed a tailwind may exist in both markets. It remains to be seen how long this anomaly may continue for, and will certainly be one to monitor going forward.

Investors should consider all the information discussed within this market update and many other factors. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Equity Market and Fixed Income returns are from JP Morgan as of 9/30/22. Rates and Economic Calendar Data from Bloomberg as of 9/30/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology. Core PCE Price Index data from the Bureau of Economic Analysis on 9/30/22, respectively. Jobless claims from the US Department of Labor on 9/29/2022.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.