Last Week’s Markets in Review: Investors Expecting a Bumpy Ride Ahead

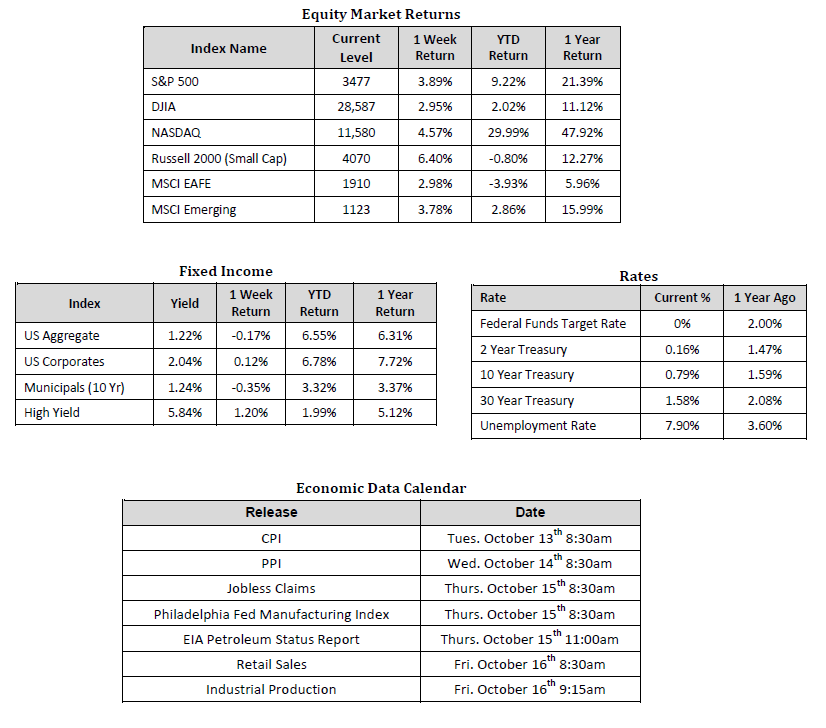

Global equity markets rallied back convincingly over the prior week. In the U.S., the S&P 500 Index jumped to a level of 3,477, representing a gain of 3.89%, while the Russell Midcap Index pushed 4.74% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 6.40% over the week. Moreover, developed and emerging international markets returned 2.98% and 3.78%, respectively. Finally, the 10-year U.S. Treasury rose to 0.79%, nine basis points higher than the prior week.

On the economic data front, Federal Reserve Chairman Jerome Powell once again made news as he implored Congressional leaders to succeed in passing an additional fiscal stimulus package, warning that failing to do so would lead to “typical recessionary dynamics.” Chairman Powell acknowledged that the economy had recovered more quickly than expected, but then doubled down on his call for more fiscal stimulus by stressing that economic growth is slowing and the unemployment picture is worse off than might appear.

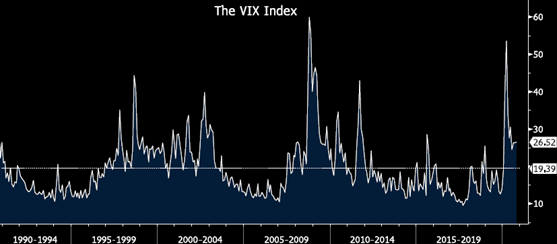

With a plethora of potential market disruptors looming over the heads of investors, including the possible failure of Congress to pass another much-needed stimulus bill, continued congressional squabbling over filling a vacant U.S. Supreme Court seat, further growth in the virality of COVID-19, escalated U.S./China trade tensions, and a U.S. Presidential election that is likely to be contested, many have turned to the VIX Index to help quantify such perceived near-term risks. For those unfamiliar, the CBOE Volatility Index, or the “VIX”, is defined by Investopedia.com as, “a real-time market index that represents the market’s expectation of 30-day forward-looking volatility.” As such, the VIX can indicate how severe gyrations in the price of the S&P 500 Index are likely to be over the next month and beyond.

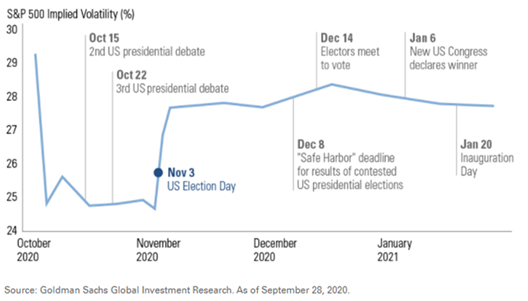

Of all the risks mentioned above, it currently appears that the potential for a drawn-out and contested presidential election is having the most outsized impact on the VIX. The chart below illustrates a significant increase in volatility that coincides with November 3 or U.S. Election Day. You’ll also notice that elevated volatility is expected to stretch into the beginning days of 2021, but does show some signs of abating as we approach inauguration day on January 20. Of course, it’s essential to keep in mind that these figures are projections and are likely to change as new information becomes available and is then absorbed by the market.

Given current expectations for elevated volatility through January 2021, we thought it useful to analyze the track record of the VIX since its inception in 1989 to glean what constitutes as a “normal” level of volatility, and ultimately discern whether the current VIX reading of 28 constitutes above average volatility in a historical context. Our research shows that the current level of 26.52 is indeed above the index’s longer-term average of around 20. However, it is also substantially lower than the high of 53.54 registered during the early stages of the COVID-19 pandemic this year. So, while the VIX may have retreated from the outstretched levels reached in March and April, it continues to hold at a level that has many stock investors feeling uneasy. We understand this sentiment but believe that concern based primarily on heightened forward-looking volatility may be misplaced.

Source: Bloomberg

In our view, it has been more useful in recent history to view the VIX as a contrarian indicator, rather than a harbinger of negative returns. In other words, the VIX was either below or slightly over 20 in the lead up to the Tech Bubble in 2000, the Great Financial Crisis of 2008, and the Coronacrisis of 2020. In fact, in each of these three market crashes, the S&P 500 Index went on to generate excellent returns in the two years following each respective peak in the VIX. The S&P 500 Index returned 38.57% over the two years following the VIX’s peak in the aftermath of the Tech Bubble, 55.65% over the two years following the VIX’s peak after the Great Financial Crisis of 2008, and 36.56% over the seven months since the VIX peaked in response to the Coronacrisis.

Chairman Jerome Powell’s less than optimistic comments on the current state of the economy, Congress’s inability to pass an additional stimulus package, the continued spread of COVID-19, and the potential for a hotly contested Presidential election will all likely contribute to increased levels of volatility as we move into year-end. For these reasons, we continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, timeframe, and tolerance for risk.

We recognize that these are very troubling and uncertain times, and we want you to know that we are always here to help in any way we can. Please stay safe and stay well.

Data Sources: Equity Market and Fixed Income returns are from JP Morgan as of 10/9/20. Rates and Economic Calendar Data from Bloomberg as of 10/9/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology. S&P 500 sector performance represents total return figures sourced from Bloomberg.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.