Last Week’s Markets in Review: Investors Hope for Better Days in 2023

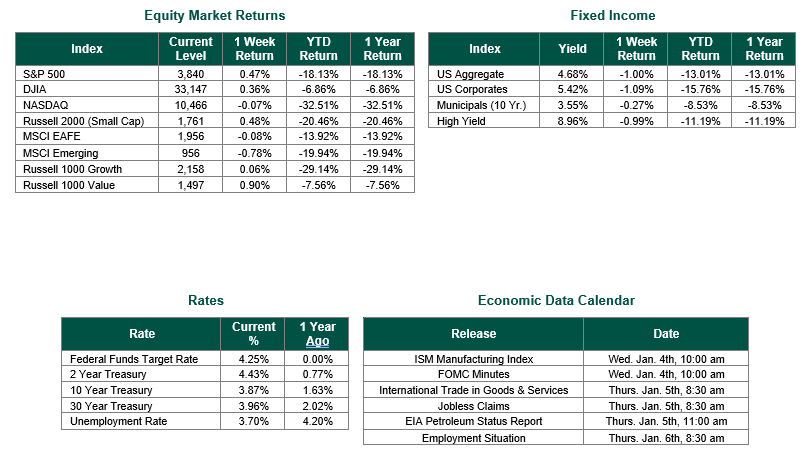

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,840, representing an increase of 0.47%, while the Russell Midcap Index moved -0.12% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.48% over the week. As developed, international equity performance and emerging markets were lower returning -0.08% and -0.78%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.87%.

We want to begin our weekly update by wishing everyone a happy and successful New Year!

The last week of any calendar year typically is a quiet week for economic developments, and 2022 was a good example of this. The most eventful data released last week was the weekly jobless claims on Thursday. Initial claims for the week of 12/24/22 inched higher to 225,000. Claims slightly exceeded both the consensus estimate of 222,000 and the prior week’s claims of 216,000. This level of claims remains historically low, further supporting a resilient employment market that has thus far withstood all of the negative economic news of 2022.

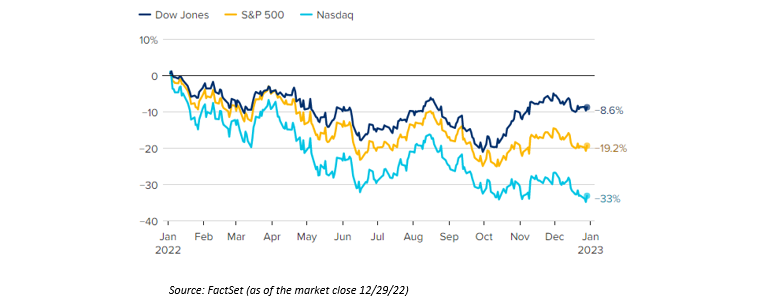

Most investors are happy to close out 2022 and move forward into 2023. Both equities and fixed income experienced relatively significant losses for 2022. Furthermore, all three major equity indexes experienced their worst years since 2008. The yearly performance of the three indexes is depicted in the graph below.

Fixed-income investors also suffered losses in 2022. A snapshot of these losses can be observed by following the yield of the benchmark 10-year U.S. Treasury, remembering that bond prices typically move inversely to yields. The yield for the 10-year U.S. Treasury began the year at 1.5%, peaked at 4.3% in October, and will finish the year in excess of 3.8%.

It is our opinion that most, if not all, of this negative performance, can be traced back to three major economic themes that dominated 2022:

1. The Federal Reserve aggressively raised interest rates by 425 Bps (i.e., 4.25%).

2. Persistent inflation at record levels

3. War in Ukraine and other geo-political conflicts

As we embark on a New Year, we believe that the Fed will continue to decrease the severity of its restrictive monetary policy throughout the course of the first half of 2023 as inflation declines. If this is the direction of the Federal Reserve, and inflationary pressures continue to moderate, perhaps better days are ahead for equity and bond investors. Regardless, more short-term bouts of volatility should be expected. Investors would be wise to review their portfolios with financial professionals at the start of 2023 to ensure that they are positioned consistently with their financial goals, risk tolerance, and investment timeframe.

Best wishes and great prosperity for both the week and New Year ahead!

Weekly Jobless Claims data is sourced from the Department of Labor. Equity indexes performance data is sourced from FactSet. Equity Market and Fixed Income returns are from JP Morgan as of 12/30/22. Rates and Economic Calendar Data from Bloomberg as of 12/30/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.