Last Week’s Markets in Review: Investors Ponder Impact of Upcoming Elections

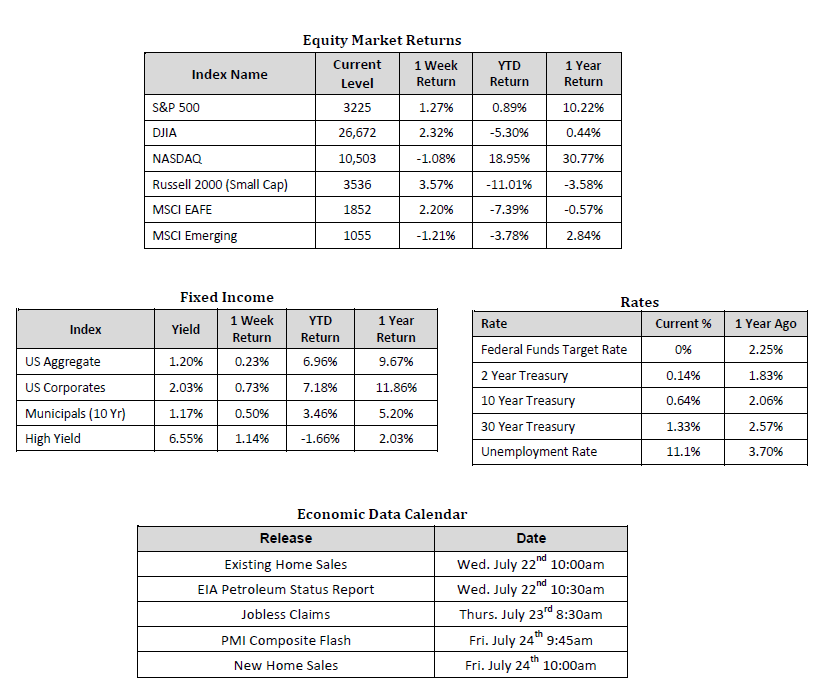

Global equity markets rallied higher following a string of positive announcements on the economic data, quarterly earnings, and vaccine development fronts. In the U.S., the S&P 500 Index rose to a level of 3,225, representing a gain of 1.27%, while the Russell Midcap Index pushed 3.04% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.57% over the week. Moreover, developed and emerging international markets returned 2.20% and -1.21%, respectively. Finally, the yield on the 10-year U.S. Treasury held firm, finishing the week at 0.64%.

Investors warmly welcomed another week of upside surprises on the economic data front, which we’ll dive into momentarily, but first, we’d like to address the potential political risk investors are increasingly keying in on as we move closer to Presidential and Congressional elections in November. Earlier in the year, we wrote about whether investors should worry about presidential elections, which can be found here, and their potential impact on the stock market. Historical data shows that there is no clear trend in stock market performance leading into an election, indicating that a presidential election alone should not necessarily influence investment strategy.

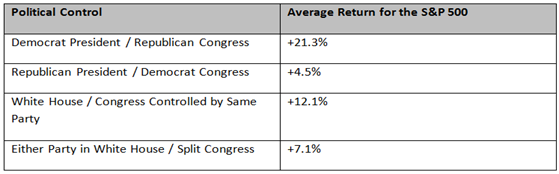

Perhaps even more important to stock market performance than who is in the Oval Office after a presidential election in which political party is in control of Congress. As a reminder, not only is our country’s President for the next four years on the ballot on November 3rd, but elections will take place for House of Representative seats from all 435 congressional districts across each of the 50 U.S. states in addition to elections for 35 of the 100 seats in the U.S. Senate. To this end, based on an MFS research report entitled, “Primaries, caucuses, and elections…oh my!”, based on data from Ned Davis Research, from 1900 – 2008,, it appears that all different combinations of political party combinations have produced positive historical returns from 1961-2010, on average, for the stock market, which is defined in this case by the S&P 500 index, though some combinations have historically been better than others.

Please note: Figures referenced are price change only and do not include the impact of reinvested dividends. The Standard & Poor’s 500 Index (S&P 500) measures the broad U.S. stock market. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

While November’s elections will surely create outsized near-term volatility, we prefer to look past that, and instead focus on the innovative, hard-working, unrelenting spirit of the American workforce. That spirit is a constant and has persisted through every political administration since our country’s founding. Do near-term political risks exist? Of course they do, but we don’t believe that any politician or political party can permanently alter the spirit that has defined the American workforce for generations.

Countless studies have shown that American workers, including those here on a work visa, are more productive and work more hours than their foreign counterparts. Moreover, U.S. laborers, relative to their international peers, place more importance on their careers and believe their careers are a defining aspect of their lives. This attitude is ingrained in the American culture and spreads to anyone who joins that culture, and it is hard to believe that any politician or political party can fundamentally change this. Increased taxes may drag on economic growth for a time, but it won’t stop American ingenuity from developing a breakthrough treatment for some insidious disease or the next groundbreaking technological advancement. Steve Jobs, Jeff Bezos, and Elon Musk didn’t consider tax policy before embarking on passions that ultimately changed the world, and our guess is that the next and current generation of innovators won’t either. American innovation and productivity doesn’t stop for anyone or anything, which is why we continue to favor U.S. capital markets over all others despite elevated political risks.

Now, turning back to economic news, the NFIB Small Business Optimism report and the Consumer Price Index (CPI) report released on Tuesday gave investors plenty to feel good about. The NFIB Small Business Optimism report came in at 100.6 in June, well above expectations for 97.8, and the prior months reading of 94.4. While the focus of our weekly updates is typically centered around public equity and fixed income markets, it’s important to remember that small businesses account for the majority of annual U.S. Gross Domestic Product (GDP), and are thus vital to the health and stability of the overall economy.

Regarding CPI, which is a measure of prices paid by consumers for a market basket of consumer goods and services, we saw a month-over-month increase of 0.6% in Headline CPI, essentially in line with expectations for a 0.5% increase, and substantially better than the prior months 0.1% decrease. This also marks the largest month-over-month increase in CPI since 2012, largely due to consumers putting stimulus checks and enhanced unemployment benefits to work. Moreover, Core CPI, which excludes volatile price components like food and energy, saw a monthly increase of 0.2%, which was in line with expectations, and better than the prior months 0.1% decrease.

Furthermore, industrial and manufacturing data continued to impress to the upside, with the Empire Manufacturing report and the Industrial Production report registering month-over-month increases well above consensus. Finally in economic news, Retail Sales, which was one of the last pieces needed to formulate a more accurate second-quarter GDP forecast, showed a monthly increase of 7.5% against expectations for 5%, indicating that second-quarter GDP contraction might not be quite as deep as initially expected, though still likely to be very sizeable.

With 2nd quarter earnings season fully underway, led primarily by the Financials sector, economic data reports weren’t the only thing garnering investor attention. Pepsi kicked off the 2nd quarter earnings season reporting revenue and Earnings-Per-Share (EPS) figures comfortably above analyst expectations followed by a slew of financial institutions that produced equally impressive results. Consider some of the world’s largest banks such as JPMorgan Chase, Citi, Goldman Sachs, Bank of America, and Morgan Stanley, all of which produced quarterly results that exceeded revenue and EPS expectations. Outperformance wasn’t exclusively reserved for the Financials sector, as Johnson & Johnson, Domino’s Pizza, and Abbott Laboratories all turned in revenue and EPS results comfortably above expectations, though many were lower on a year-over-year basis.

The economic and earnings picture has looked increasingly encouraging on a relative basis of late, but investors shouldn’t make the mistake of being lulled into a false sense of comfort that the waters will be smooth sailing from here on out as they most certainly will not be. Uncertainty remains near all-time highs, which is unlikely to change while such large swaths of the country continue to obey quarantine and work from home orders. As we all know too well, volatility and uncertainty tend to go hand in hand which is why we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, time-frame, and tolerance for risk.

We recognize that these are very troubling and uncertain times, and we want you to know that we are always here to help in any way we can. Please stay safe and stay well.

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 7/17/20. Rates and Economic Calendar Data from Bloomberg as of 7/17/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid-cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.