Last Week’s Markets in Review: Is the Fed Right on Inflation?

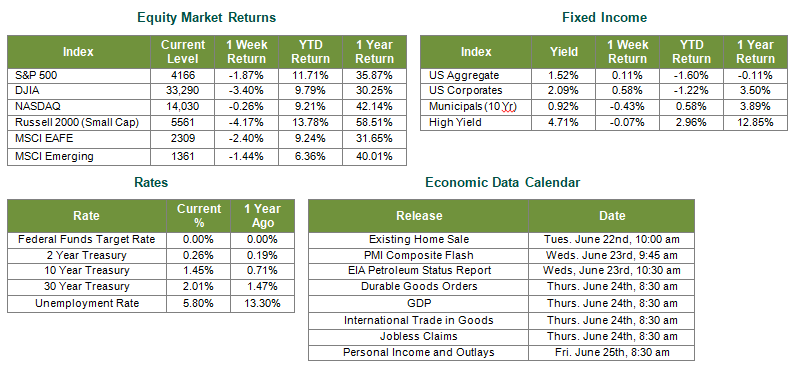

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index (S&P 500) reached record highs and closed the week at a level of 4,166, representing a loss of 1.87%, while the Russell Midcap Index moved 3.09 % lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -4.17% over the week. International equity performance was also negative as developed, and emerging markets returned -2.40% and -1.44%, respectively. Finally, the 10-year U.S. Treasury yield ticked lower, closing the week at 1.45%.

Traditionally, our updates follow a familiar format where we discuss market-moving news or timely topics and their potential implications on investment portfolios. This week we’re going to flip the script. The volume of client inquires around interest rates, inflation and positioning warrant an overall discussion of our views on these topics before we dive into related details from the Federal Open Market Committee (FOMC) meeting last Wednesday.

Regarding interest rates and bond-purchase tapering, the Federal Reserve (“Fed”) is not currently taking action and there has not been material messaging on plans to do so in the immediate future. There is simply too much noise regarding inflation and the labor markets, stemming from COVID-19, therefore, more data is needed. With respect to portfolio positioning, we believe investors should exercise patience and avoid short-term reactionary moves that could have longer-term consequences. From our standpoint, the outlook for the economy and stock market is generally positive as the economy continues to strengthen, earnings are strong, vaccinations are expanding, states are reopening, and monetary policy is accommodative. This outlook does not imply that the days of volatility are behind us, because they are not, and investors would be wise to re-visit their portfolios to ensure that they have the diversification in place to help withstand short-term bouts of volatility if and when they arise. Despite the potential for market volatility and the stretched valuations of certain areas of the equities markets, we do still see growth opportunities domestically and abroad, in a variety of sectors, and across numerous market caps and styles.

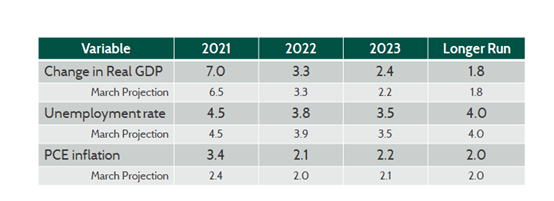

Next, let’s talk about the details of the highly anticipated FOMC meeting last week and the release of the “Summary of Economic Projections.” While the committee decided to leave the federal funds target rate and asset purchase program unchanged at this time, as expected, there were a handful of notable takeaways from the release and Chairman Powell’s press conference afterward. Below is a summary of the median projections of the FOMC members and a comparison to the March 2021 figures.

No changes were made by the Fed to their longer-run forecasts. However, the current year’s Gross Domestic Product (GDP) and inflation expectations were revised upward. While the Fed is undoubtedly acknowledging the presence of inflation and inflationary pressures, their messaging remains consistent in that they believe that the drivers behind the significant spike that we saw in April and May are largely “transitory”. We tend to agree as the spikes that we saw in April and May are unlikely to continue but more muted inflationary pressures are likely to stick around for the foreseeable future.

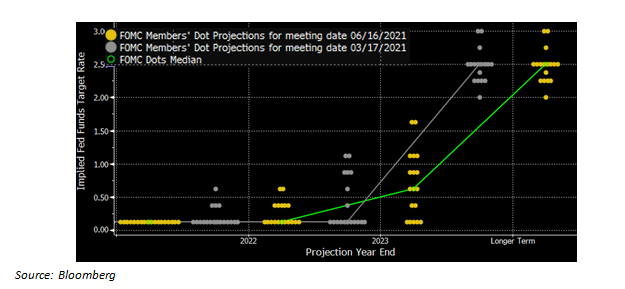

The information above was not the primary reason that the S&P 500 moved lower by 0.75% shortly after 2 pm on June 16th. Rather, that downward move was likely a reaction to a shift in the Fed’s “dot plot” chart, which depicts each voting member’s outlook on the benchmark Federal Funds Target Rate.

The chart above shows the projections released last Wednesday (yellow) compared to March’s release (grey) and the median rates for each respective data set. The chart suggests that the Fed may act sooner than previously planned, specifically suggesting two potential rate hikes in 2023. We view this as a more positive sign that the U.S. economy is approaching full employment and a sustainable level of inflation quicker than previously anticipated, though still some time away. Nonetheless, yields on the 10-year U.S. Treasury immediately spiked 10 basis points and the stock market initially fell.

What shouldn’t get lost in the apparent concerns over rising interest rates is that the labor market is strengthening and economic growth is robust. Economic growth is typically associated with additional growth potential for stocks. With that said, investors are rightfully concerned if benchmark rates are increased too soon, or in too large of incremental movements, to pose a threat to the continued economic recovery. However, the Fed has made no indication that such moves are under consideration. An equally important consideration is whether the Fed will wait too long to raise rates, and thus allow inflation to have a damaging impact on the U.S. economy. We do not currently have concerns that the Fed will wait too long to act and view their updated dot plot chart and messaging around discussions commencing soon around bond purchase tapering as constructive and comforting.

Given all of the confusion around news headlines and economic data reports, we encourage investors to work with experienced financial professionals to help build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk. Best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 6/18/21. Rates and Economic Calendar Data from Bloomberg as of 6/18/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.