Last Week’s Markets in Review: Jobs Reports and OPEC Cut Stoke Inflation Worries

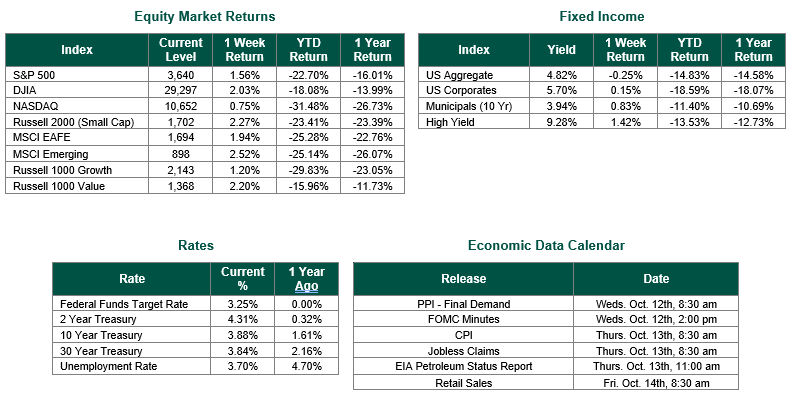

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,640, representing an increase of 1.56%, while the Russell Midcap Index moved 1.25% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.27% over the week. As developed, international equity performance and emerging markets were higher returning 1.94% and 2.52%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.88%.

The markets have gotten to a point where all economic data that is released, good or bad, is immediately applied to the probability of perceived future rate hikes by the Federal Reserve. This week, most economic data releases pertained to employment. The exception was on Thursday when OPEC announced plans to reduce global production amongst member countries. Throughout the remainder of this update, the employment and OPEC news will be analyzed. Our analysis will include commentary concerning how markets reacted to the economic data, in particular, the probability of the Federal Reserve’s next rate hike.

Last Tuesday saw the first employment data reported in the Job Openings and Labor Turnover Report (JOLTS) for August. The Federal Reserve has stated that it gives much consideration to the JOLTS data within its monetary policy analysis. Job openings totaled 10.05 million in August, this compared to 11.17 million openings reported in July. The 10% decrease from the prior month along with the August total being well below the consensus estimate was interpreted as a data point that supported a less aggressive Fed for the remainder of the year. Equity markets rallied as a result throughout the day.

Equity markets digested two other employment reports: ADP employment report for September and Weekly Jobless Claims, on Wednesday and Thursday. Both reports were slightly above the consensus estimates. Market participants began to reexamine their rate hike analysis and equity markets turned south as yields climbed higher.

The announced production cuts of 2 million barrels per day by OPEC last week can be viewed as an inflationary event that will potentially cause the Federal Reserve to be more hawkish. However, it should be noted that many member countries were already producing below their quotas prior to the announcements, so the overall impact on global oil production might not be as severe as the headline number might suggest. Domestic markets did not have a real opportunity to react, as the announcement came late in the trading session on Thursday.

On Friday morning, the Bureau of Labor Statistics (BLS) released the Employment Report for September. The September report showed that job growth had slowed slightly from the current trend. Employers added 263,000 new jobs to non-farm payrolls. This result was down from 315,000 in August. It was also slightly below the consensus estimate of 275,000 jobs. Additionally, the overall unemployment rate fell to 3.5% from 3.7% in August, though the labor force participation rate also declined. Lastly, it was reported that annual gains in average hourly earnings eased to 5.0%. Market participants viewed the overall report as an indication that the jobs market was still relatively robust and unlikely to help in the battle against inflation. Both the overall unemployment rate and the average hourly earnings were cited as inflationary events. Markets reacted to the idea that the Fed will need to maintain its unprecedented battle to lower inflation as result. This sentiment can be measured by utilizing the CME FedWatch Tool from the CME Group, we will demonstrate how this economic data has moved market sentiment concerning the future actions of the Federal Reserve:

• There is an 80% probability that the Fed Funds Target Rate will be between 3.75% – 4.00% (representing another increase of 75 Bps at the November 2nd meeting).

• The current probability represents a 42% increase in the probability of a 75 Bps increase from the week prior.

Equity markets sold off by the end of the trading session on Friday as all three of the major equity indices moved lower by greater than 2%. The NASDAQ Composite performed the worst of the three well-known stock indices with a daily loss of 3.8%.

Like Chairman Powell and the FOMC, markets are data-driven. Our readers should be reminded that the next meeting of the FOMC is on November 2nd and that there will be many economic data points between now and then. We would expect the data points to continue to create volatility in the markets.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Both the JOLTS and the September Employment Report were sourced from the U.S Bureau of Labor Statistics. Equity Market and Fixed Income returns are from JP Morgan as of 10/7/22. Rates and Economic Calendar Data from Bloomberg as of 10/7/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.