Last Week’s Markets in Review: Labor Data Update Ahead of Labor Day

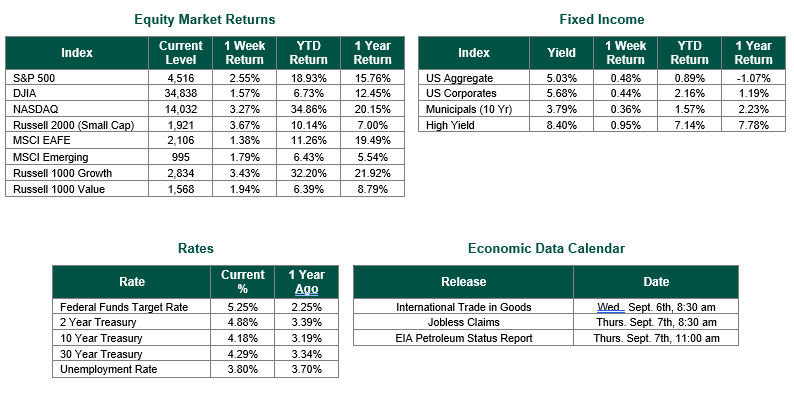

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,516, representing an increase of 2.55%, while the Russell Midcap Index moved 2.68% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.67% over the week. As developed international equity performance and emerging markets were also higher, returning 1.38% and 1.79%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.18%.

Fittingly, the week before the holiday weekend, in which we recognize workers’ contributions to America, our weekly market update revolves heavily around economic data involving labor. The release of labor data updates kicked off last Wednesday when ADP released a report indicating that private-sector employers created 177,000 jobs in August. This figure fell significantly short of the revised July total, which saw 317,000 job creations and came in about 33,000 jobs less than what was anticipated by Dow Jones economist estimates for August.

Job creation in the private sector was not the only weakening figure released on Wednesday, as we also saw second-quarter gross domestic product (GDP) revised downward to a 2.1% annual growth rate from the 2.4% pace that was previously reported. The release came as a bit of a shock to the analyst community as the consensus expectation was for there not to be any revision to economic growth.

Finally, last Friday, labor data continued to disappoint. The unemployment rate in August jumped to an unexpected 3.8% rate. Simultaneously, contrary to the unemployment rate update, nonfarm payrolls increased above expectations during August by 187,000 vs. estimates for 170,000 payroll additions. These payroll figures should be digested with caution, however, as both July and June payrolls were revised lower by 30,000 and 80,000, respectively – a likely pattern for what could be the case for August.

It is becoming increasingly clear to us that the intended consequences of the aggressive rate hikes of the Federal Reserve since March of 2022 are starting to impact the labor market and the economy.

Employment data from the Bureau of Labor Statistics on 9/1/23. GDP Data from the Bureau of Economic Analysis on 8/30/23. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 9/1/23.

Economic Calendar Data from Econoday as of 9/1/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.