Last Week’s Markets in Review: March Madness All Over Again

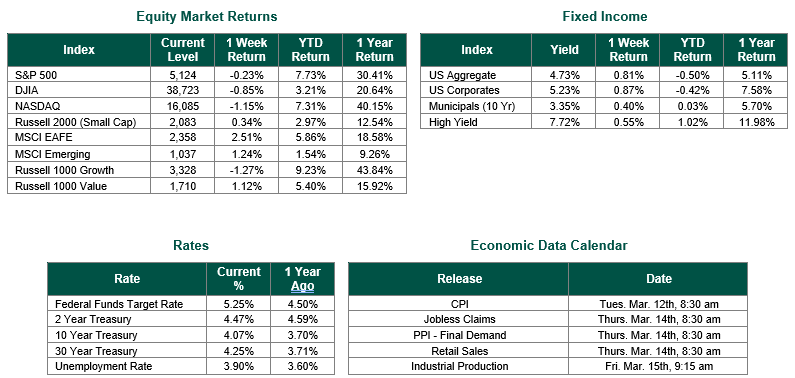

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,234, representing an increase of 2.31%, while the Russell Midcap Index moved 1.77% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.61% over the week. Developed international equity performance and emerging markets were positive, returning 1.24% and 0.53%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.20%.

Exactly two years ago, we had written a market update labeled “March Madness.” The basis of the commentary was not about the excitement surrounding the NCAA basketball tournament as many would have likely preferred, but rather, it was talking about the commencement of the Fed’s interest rate hiking cycle. At the time of their first 0.25% increase of this rate hike cycle, the open market committee had projected a target Fed Funds rate of 2.8% for 2023 and 2024, GDP growth in 2022 of 2.8%, and an inflation forecast of 4.3%.

If the Fed’s forecasting ability in 2022 were used to predict an NCAA bracket, they would have quickly been busted! Interest rates were not increased to 2.8% but instead were raised to a range of between 5.25% and 5.50% – a 23-year high! Real GDP in 2022 increased by just 2.1%, and the PCE price index (the Fed’s preferred inflation gauge) increased by 6.5%. Fed officials ultimately underestimated the stickiness of inflation and the difficulty to inflict pressure on the labor market.

The Federal Reserve wrapped up its March 2024 rate announcement two years later by standing pat. The updated Dot Plot chart suggests that the Fed is still forecasting 75 BPs in rate cuts for 2024, which would keep them well above their target set at the onset of rate hikes in 2022. Fed officials now forecast that the economy will slow to a growth rate of 2.1% in 2024 and stay at 2% through 2026, with inflation returning to its 2% target by 2026.

We hope that the Fed will be a better predictor than they have been in the past. However, they do not have a crystal ball, and history suggests this task will be difficult. Despite the uncertainty in our economy’s future, our outlook for lower rates, yields, and inflation over the next two to three years remains intact, creating stock and bond opportunities for investors to consider.

One final update from last week: it was reported this weekend that President Biden signed the $1.2 trillion spending package from Congress into law hours after the Senate passed at 2 a.m. (ET) Saturday morning. The passage will keep the government funded until October 1, 2024, just before the presidential election.

Best wishes for the week ahead, and good luck with your March Madness brackets!

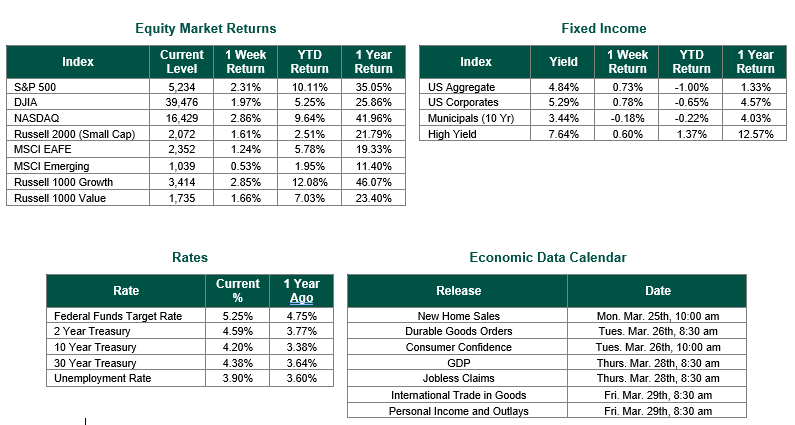

PCE Inflation data sourced from the Bureau of Economic Analysis on 3/21/2024. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 3/22/24. Economic Calendar Data from Econoday as of 3/25/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.