Market Momentum Takes Rotational Shift

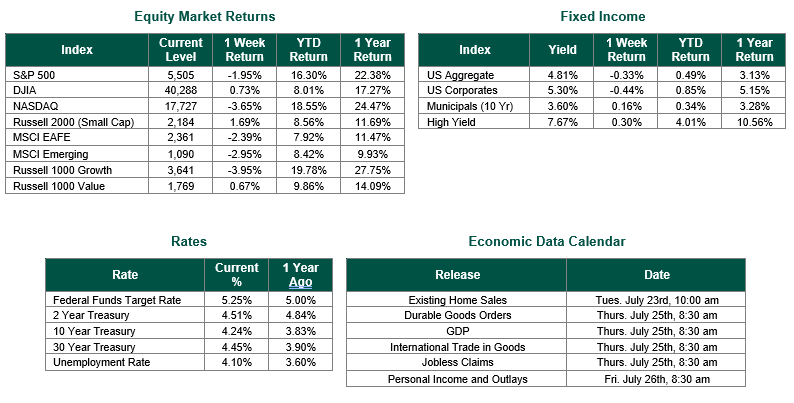

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,505, representing a decrease of 1.95%, while the Russell Midcap Index moved -0.11% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.69% over the Week. As developed international equity performance and emerging markets were lower, returning -2.39% and -2.95%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.24%.

Stock market momentum stalled over the past week as a rotational shift amongst investors ended a torrid run by the S&P 500 index. The change in expectations over interest rates that we discussed in last week’s update by the futures markets had market participants shifting into small-cap equities that typically benefit the most from a reduction in interest rates. As a result, the small-cap-oriented Russell 2000 index gained by 1.69%, while the S&P 500 and the Nasdaq Composite indexes fell by 1.95% and 3.65%, respectively. Much of the deviation in returns is likely due to certain investors taking some profits in existing large cap technology stocks and redeploying these funds to other areas of the market, such as small-cap stocks. Whether this activity is the beginning of a longer-term shift in asset positioning or a short-term tactical event remains to be seen.

The second quarter earnings season also kicked off over the past week. Markets welcomed strong reports from names such as Goldman Sachs, American Express, and Netflix. With the economy slowing, seeing earnings expansion and positive guidance are exactly what market participants will need to help justify current stock market prices. As of 7/19/24, with 14% of S&P 500 companies reporting actual results, 80% have reported a positive EPS surprise, and 62% have reported a positive revenue surprise, according to FactSet.

Despite having one of the worst trading sessions in years in the semiconductor sector, Taiwan Semiconductor Manufacturing Co. Ltd. (Ticker: TSM) said that constraints in high-end artificial intelligence (AI) chip supply are impacting the ability to keep up with the demand for such products. The company reported just over 40% revenue growth from a year ago, with profits also increasing by just over 36%. The demand for AI continues to be the main driver of asset returns so far this year. In fact, AI is beginning to prove just how effective it can be for companies behind the scenes. During Amazon’s “Prime” day, the company reported a record $14.2 billion in U.S. spending, which was an 11% increase compared to last year, according to Adobe Analytics. Amazon attributed the massive increase in spending to AI shopping tools that help to influence customer browsing preferences.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 7/19/24. Economic Calendar Data from Econoday as of 7/19/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.