Last Week’s Markets in Review: Markets Decline on Hawkish Sentiment

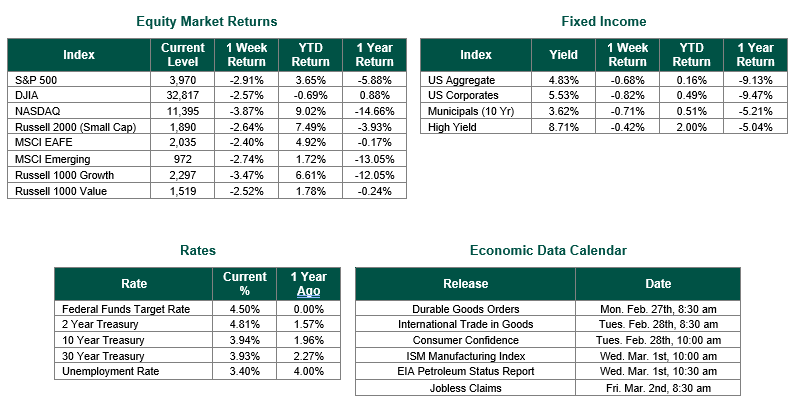

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,970, representing a decline of 2.91%, while the Russell Midcap Index moved 2.28% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.64% over the week. As developed, international equity performance and emerging markets were also lower, returning -2.40% and -2.74%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.94%.

After snapping a streak of four consecutive down days in the S&P 500, the index would drop back into the red after the release of additional hot readings on inflation. In what continues to be a storyline carryover from 2022, and an extension of last week’s review, inflation continues to dominate market headlines. Friday’s PCE (personal consumption expenditures) index, the preferred inflation measurement tool by the Fed, increased at a 0.6% rate in January. The reading would be 0.1% higher than expected on a month-over-month basis and 0.3% higher than consensus expectations of 4.4% on a year-over-year basis. When considering food and energy, which are the more volatile portions of PCE, the index increased by 0.6% and 5.4% on a monthly and yearly basis, respectively.

Whether continued inflationary pressure will force the Federal Reserve to be more aggressive with their constricting monetary policies and whether those actions would push the U.S. economy into a deep recession remain at the top of investors’ minds. Comments from Federal Reserve officials on Friday would not lessen the concern, as Cleveland Reserve President Loretta Mester presented hawkish rhetoric stating, “I see that we’re going to have to bring interest rates above 5%… We’ll figure out how much above.” These comments come as a bit of a surprise as Mester had recently admitted to being one of the more cautious members of the Federal Reserve, voting for lower rate hikes during the Fed’s last committee meeting. If recent economic reports are swaying the more cautious Fed members, it seems inevitable that the rate cycle is not near an end just yet.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and risk tolerance.

Best wishes for the week ahead!

PCE data from the Bureau of Labor Statistics on 2/24/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 2/24/23. Economic Calendar Data from Econoday as of 2/24/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.