Last Week’s Markets in Review: Markets Look for Another Fed Pause this Week

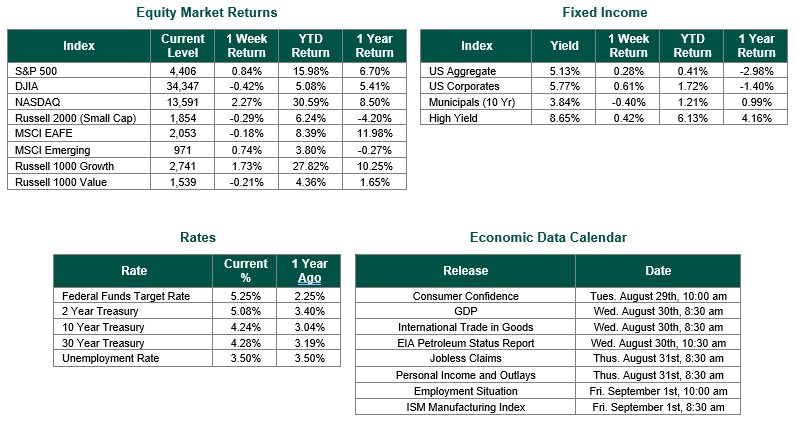

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,604, representing an increase of 0.24%, while the Russell Midcap Index moved 0.28% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.00% over the week. As developed international equity performance and emerging markets were mixed, returning 0.39% and -0.70%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.23%.

The past week saw a great deal of fresh economic data released to the markets. There were reports concerning employment, inflation, and consumer sentiment for investors to digest and react upon. All this economic information was factored into investors opinion concerning monetary policy and the next Federal Open Market Committee (FOMC) meeting which takes place this week.

The data concerning employment was the most prevalent. On Tuesday the Labor Department released the JOLTs report for October. Job openings tumbled to their lowest level in 2 ½ years. Employment openings totaled a seasonally adjusted 8.73 million, representing a decline of 6.6%. This result was well below the 9.4 million consensus estimate. Federal Reserve policymakers follow this data closely for signs of weakness in the national labor markets. Wednesday and Thursday also saw employment data released in the ADP Employment Report and the Weekly Jobless Claims report.

On Friday, the Labor Department reported the November job numbers, which showed that job growth accelerated, while the unemployment rate fell to 3.7%, signs of underlying labor market strength that suggested financial market expectations of an interest rate cut early next year were probably premature. We believe the Federal Reserve’s gauge of the employment market throughout this rate cycle has been relatively spot on. It’s reading and confidence in the domestic Jobs market allowed a historically aggressive hiking cycle to battle inflation without significantly derailing the overall economy – thus far.

Economic activity in the services sector expanded in November for the 11th consecutive month as the Services PMI® registered 52.7%, according to the nation’s purchasing and supply executives in the latest Services ISM® Report On Business.® .”In November, the Services PMI® registered 52.7%, 0.9% higher than October’s reading of 51.8%. The composite index indicated growth in November for the 11th consecutive month after a reading of 49.2% in December 2022, which was the first contraction since May 2020.

Last week we also learned that U.S. consumer sentiment perked up much more than expected in December, snapping four straight months of declines, as households saw inflation pressures easing, a development likely to be welcomed by Federal Reserve officials, a survey showed on Friday. The University of Michigan’s preliminary reading of its Consumer Sentiment Index shot up to 69.4, the highest since August, from November’s final reading of 61.3.

All the above data, in addition to other critical economic data, will be considered in the FOMC’s next rate decision, which will be released on December 13th. It is greatly anticipated that the Federal target rate will remain unchanged at the December meeting, representing another “pause”. We still contend that, in all likelihood, we have reached the end of this rate hike cycle.

Best wishes for the week ahead!

Employment data is sourced from The Labor Department. PMI data sourced from the Institute for Supply Management. Consumer Sentiment data sourced from the University of Michigan. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 12/1/23. Economic Calendar Data from Econoday as of 12/11/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.