Markets Rallied Last Week Prior to U.S. Credit Downgrade

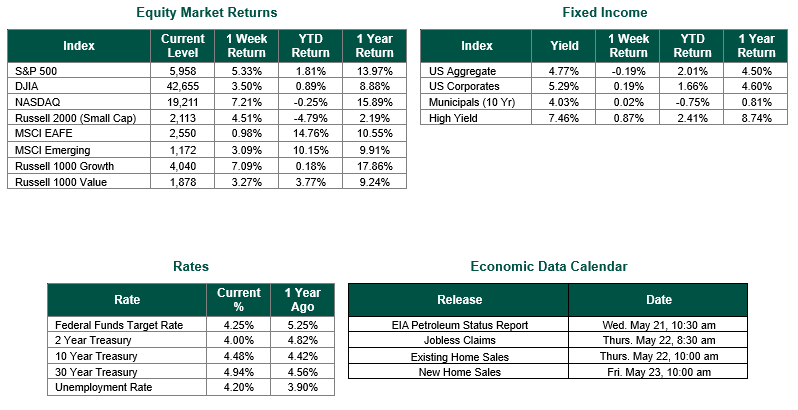

Global equity markets finished positive for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,958, representing a gain of 5.33%, while the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 4.51% over the week. Developed international equity performance and emerging markets were also strong, returning 0.98% and 3.09%, respectively. Finally, the 10-year U.S. Treasury yield moved up, closing the week at 4.48%.

The 90-day U.S./China tariff pause lifted sentiment early in the week, as did President Trump’s Middle East trip, securing significant artificial intelligence (AI) and technology investment deals. The stock market rallied on this news, pushing the S&P 500 index into positive territory for the year and to its highest level since February 24, 2025.

However, on Friday, Moody’s downgraded the U.S. credit rating from Aaa to Aa1, citing a soaring $36 trillion national debt and persistent fiscal deficits. In 2024, the deficit was $1.8 trillion, equivalent to 6.4% of GDP, and the Congressional Budget Office (CBO) projects the deficit to continue to grow in the coming years, reaching 6.9% of GDP by 2034. Rising interest costs, entitlement spending, and political gridlock over tax and spending reforms were key drivers behind the ratings action. The downgrade, following S&P’s and Fitch’s downgrades in 2011 and 2023, respectively, may raise borrowing costs, with 10-year Treasury yields briefly exceeding 4.5% and 30-year yields topping 5.0% as the markets opened on Monday. While Moody’s assigned a stable outlook, noting the U.S.’s resilient economy and dollar reserve status, the U.S. debt-to-GDP ratio, meaning the total debt divided by the gross domestic product, was 124.30% in 2024. The ratio has fluctuated historically, reaching a high of 126.30% in 2020 and a low of 31.80% in 1981.

The late-week credit rating downgrade by Moody’s tempered market optimism, highlighting concerns over rising U.S. debt. The ensuing rising yields in bonds reduced expectations for Federal Reserve rate cuts, now at two for 2025, down from three (or potentially four) rate cuts the prior week, according to the CME group. The 2-year Treasury yield reached 4.06%, with a flattening yield curve reflecting a solid labor market (Ex. with the unemployment rate currently at 4.2%) and persistent, though not rising, inflation.

Despite the stock market’s recent rally, challenges remain. The traditional inverse relationship between stocks and bonds has weakened, suggesting market imbalances. Rising bond yields could increase borrowing costs, potentially slowing growth. Analysts warn that unresolved trade tensions and fiscal pressures may spark more short-term bout of volatility, with some pointing to the risk of a policy-driven economic downturn – which, of course, could lead to Federal Reserve accommodation through interest rate cuts or balance sheet expansion. While markets are buoyed by short-term relief, clarity on trade and fiscal policy will help shape the path forward.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 5/2/25.GDP Data sourced from the Bureau of Economic Analysis on 4/30/2025. Jobs data sourced from the Bureau of Labor Statistics on 5/2/25 Economic Calendar Data from Econoday as of 5/5/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.