Last Week’s Markets in Review: Markets Rally on Positive Inflation Report

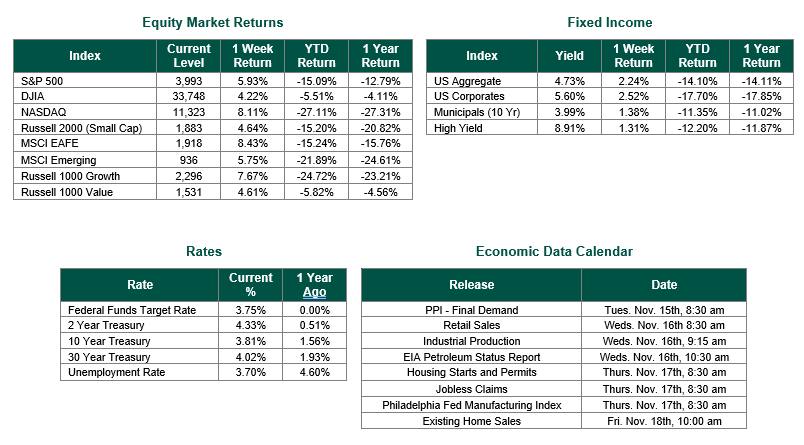

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,993, representing a gain of 5.93%, while the Russell Midcap Index moved 5.72% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 4.64% over the week. As developed, international equity performance and emerging markets were higher returning 8.43% and 5.75%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.81%.

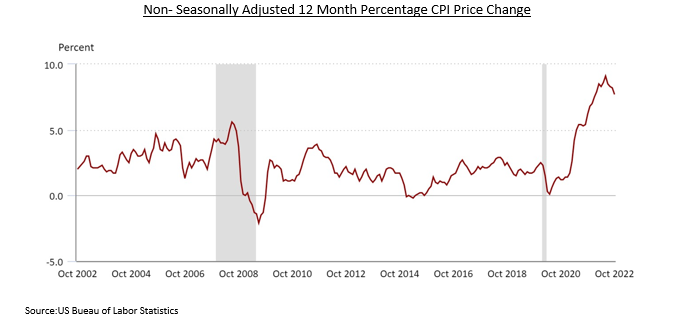

Alas! After months of disappointing inflation reports, economists and market participants alike were handed refreshing news on consumer prices last week. The consumer price index (CPI) reading for October measured a 0.4% month-over-month and 7.7% year-over-year increase, both of which coming in below consensus expectations of 0.7% and 8.0%, respectively. Core-CPI, which excludes food and energy costs, also increased, albeit at a slower-than-expected pace, by 0.3% over the month and 6.3% for the year.

Source:US Bueau of Labor Statistics

The reading would suggest that perhaps the aggressive hawkish monetary policies implemented by the Federal Reserve are finally reaping benefits. These policies have included interest rate hikes of 25 Bp in March, 50 Bp in May, and 4 consecutive 75 Bp hikes between June, July, September and November. The Fed Funds Target Rate now stands at 3.75-4.00%. In his post-hike press conference, Fed Chair Jerome Powell reiterated a need to be patient with their tightening actions as they are not immediate and would have a lagging effect. The latest CPI print would seem to confirm the confidence within his statement. But have we reached peak inflation, and in return peak hawkishness from the Federal Reserve? We believe that we will soon find out the answer to these two questions. According to the CME Group Fed Watch tool, the probability of a 50 Bp hike in December increased last week from ~60% to ~80%, and in February from ~52% down to ~40% with a greater probability now of just a 25 Bp hike, following last week’s moderating inflation report. If this is to be the case, October’s CPI would be significant for both the markets and the economy. As we have mentioned in previous updates, according to Blackrock, the S&P 500 has increased, on average, 11.5% in the year following peak inflation, dating all the way back to 1927.

As a result from the positive news, markets popped higher last week, with the S&P 500 index delivering the largest single-day return of 2022 at 5.54%. This result also marked the strongest single trading day since 2020. Despite the uncertainty that still exists (as of the time of this writing) regarding mid-term election results, the market was resilient as every sector within the index traded in the green. We will provide more color on what the outcome of the election may mean for markets after we obtain final ballot counts, but, as it stands now, it appears that the Republican party will take a slight edge over the Democrats in the House and a runoff election in Georgia may be the determining factor to who is in control the Senate. This outcome, if finalized, would result in a dividend government for the next two years.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and risk tolerance.

Best wishes for the week ahead, and thank you to all of the veterans who have served, and those who continue to serve, our great country!

Consumer Prices from the U.S Bureau of Labor Statistics. Equity Market and Fixed Income returns are from Bloomberg as of 11/11/22. Rates and Economic Calendar Data from Bloomberg and Econoday, respectively as of 11/11/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.