Markets Reflect the Summertime Pace

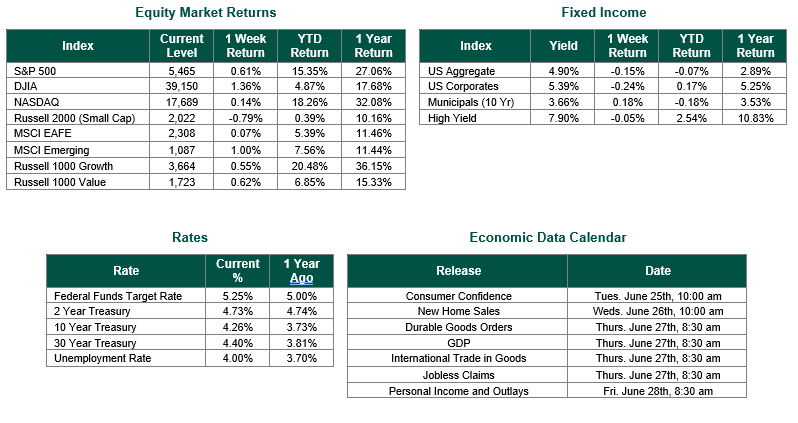

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5465, representing an increase of 0.61%, while the Russell Midcap Index moved 1.15% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.79% over the Week. As developed international equity performance and emerging markets were higher, returning 0.07% and 1.00%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.26%.

If the nationwide heat wave from last week did not signal that we have entered the summer season, the limited amount of economic data released confirmed the calendar. The week was also affected by the Juneteenth national holiday, as the markets were closed last Wednesday in observance of the day.

Last Tuesday, however, the Commerce Department reported retail sales for May. Sales rose just 0.1% on a month-over-month basis, slightly below the consensus estimate of 0.2%. Excluding auto sales, retail sales actually declined 0.1% for the month. The weaker-than-expected retail spending resulted from the consumers’ continued battle with stubbornly high levels of inflation. On a year-over-year basis, retail sales rose 2.3%.

The May retail sales data comes with investors on edge about the direction of the economy and what that direction may mean for the future of monetary policy at the Federal Reserve. Consumer spending is responsible for approximately two-thirds of gross domestic product (GDP), so any weakness could signal a reduction in growth while also pushing the Fed to begin cutting interest rates sooner or perhaps at a quicker pace than expected. Many investors are also concerned with the lack of stock market volatility thus far in 2024. Consider that there have been 119 trading days thus far in 2024, and only two of those days involved a daily move of 1.5% or more – that’s less than 2% of the time!

For investors who are fearful of a potential pullback but also fearful of missing out on more potential upside for the stock market, we would remind them of the dangers of trying to time the market. From our perspective, time in the market can be more important than market timing over the long term, provided that your portfolio strategy is consistent with your objectives, timeframe, and risk tolerance.

The market’s weekly check on employment in America, Weekly Jobless Claims, followed the summertime theme with an uneventful result. Initial claims for the week ending June 20th were 238,000, slightly higher than the expected 235,000 total and slightly lower than the prior week’s total of 243,000.

The week ended with Friday’s release of the Flash U.S. Composite PMI for June. The composite output index registered at 54.6, representing a 26-month high. Domestic business activity growth accelerated, according to the PMI survey, signaling a potential strong end to the second quarter. The service sector led the upturn with additional support from manufacturing.

Best wishes for the week ahead and the rest of the summer!

Retail sales data is sourced from The Commerce Department. Jobless Claims are sourced from the U.S. Department of Labor. PMI data is sourced from S&P Global. Economic Calendar Data from Econoday as of 6/21/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.