Last Week’s Markets in Review: Markets Retreat Amid Recession Concerns

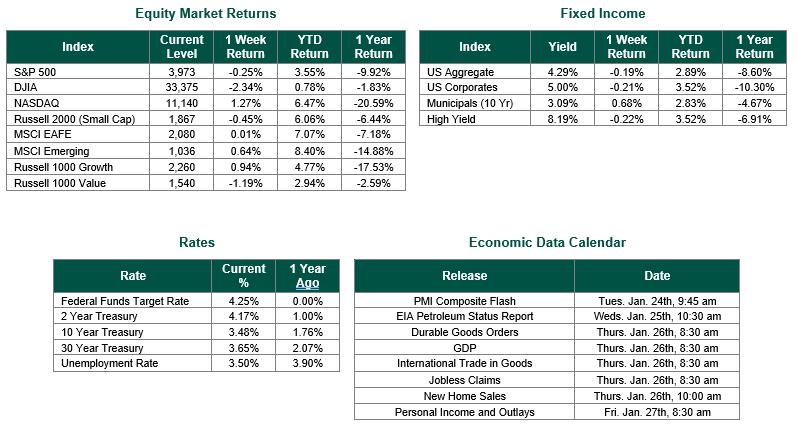

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,973, representing a loss of 0.25%, while the Russell Midcap Index moved 0.13% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.45% over the week. As developed, international equity performance and emerging markets were higher, returning 0.01% and 0.64%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly lower, closing the week at 3.48%.

After a strong start to the year, equity markets spent the past week wiping away a large portion of its 2023 early gains. The losses came as increased recession fears triggered market participants from multiple directions, all of which we will cover in this update.

Economic Releases:

Producer Prices delivered positive results in December, with the month-over-month figures well below consensus expectations of -0.1% and -0.5%, respectively. On a year-over-year basis, prices increased at a 6.2% rate but were still well below the prior reading of 7.4% and the consensus expectation of 6.8%. Poor retail sales would quickly offset the positive inflation reading. December’s release indicated a 1.1% month-over-month activity drop, a weaker-than-expected figure, and an indication of a weakened 2022 holiday shopping season.

Corporate earnings and layoffs:

Fourth-quarter earnings reports continued to roll in over the past week. As of the week’s close, according to Fact Set, 67% and 64% of companies beat on earnings and revenues, respectively. Some notable results came from Goldman Sachs (Ticker: GS) and Netflix (Ticker: NFLX), who both missed on earnings per share (EPS), while United Airlines (Ticker: UAL) and Morgan Stanley (Ticker: MS) both surprised to the upside on EPS. Paired with earnings, major layoff announcements from large technology/telecommunication service companies would contribute to weekly volatility. Among these announcements, Google notified employees they would lay off 12,000 workers, Microsoft 10,000 employees, and Salesforce 7,000.

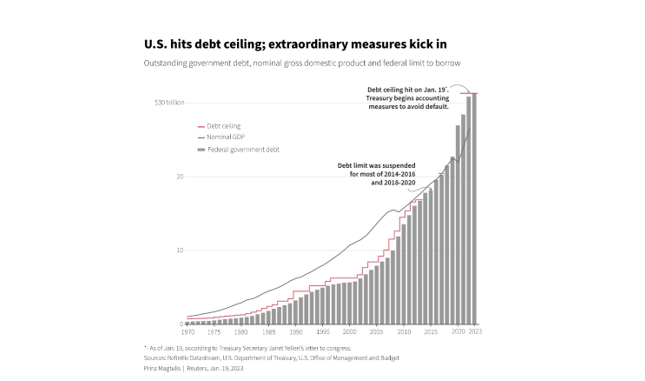

Debt Ceiling concerns:

With the current debt ceiling currently sitting at $31.4 trillion, U.S. policymakers remain in a battle over the government’s willingness to raise the debt ceiling and to what level. Since the country has less tax revenue coming in than the cost of running the government, and the debt ceiling has been reached, the U.S. cannot increase the amount of its borrowing without legislation. Without additional government funding, the creditworthiness of the U.S. treasury could be at risk of default, which would have significant repercussions across global markets. For what it’s worth, since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit.

The events that took place over the week would aggregately push market participants’ belief that there is a higher likelihood of a recession in 2023. But market participants would be prudent not to quickly infer such negative sentiment as they did over the past week. Producer prices suggested that inflation is easing, and although retail sales slowed, the drop was not significant from what was expected. Corporate earnings have been mixed with much of what was reported from the financials sector, which has had earnings hampered by poor investment banking activity. The large layoffs by corporations, although negative, may justify negative sentiment, however, the same market participants that have this view have also recently viewed increased jobless claims as a positive indicator of the Federal Reserve’s ability to slow the economy. The debt ceiling concerns would appear to be the most problematic, although it is difficult to imagine Congress not coming to some form of an agreement on this issue as they always have in the past.

It is not our view that all information is to be viewed positively. Rather, we would infer that markets may have been overacting during these critical times. For these reasons, investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Equity Market and Fixed Income returns are from Bloomberg as of 1/20/23. Rates and Economic Calendar Data from Bloomberg as of 1/20/23. Producer Prices sourced from the Bureau of Labor Statistics on 1/18/23. Retail Sales were sourced from the Bureau of the Census on 1/18/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.