Last Week’s Markets in Review: Mixed Jobs Data Puts Pressure on Fed

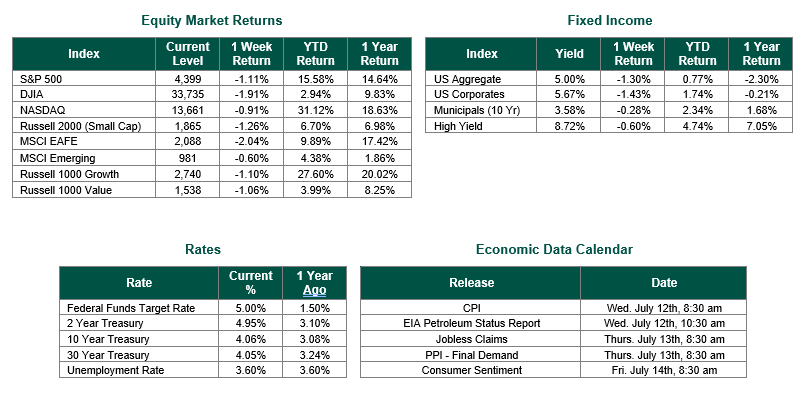

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,399, representing an loss of 1.11%, while the Russell Midcap Index moved 0.04% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.26% over the week. As developed, international equity performance and emerging markets were also lower, returning -2.04% and -0.60%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.06%.

Mixed reports on employment paired with minutes from the June Federal Open Market Committee (FOMC) meeting pushed markets lower in the holiday-shortened trading week. As you may recall, in June, the Federal Reserve (Fed) paused raising interest rates further while assessing the impact of their previous ten hikes. Despite this decision, minutes from the June meeting would show that all open market committee members did not favor this verdict and that some insisted that rates should continue to climb higher if inflation remained high. Notably, these members that favored a hike commented that the conviction to do so comes from a very tight labor market and stronger-than-expected economic activity.

Initially, data from ADP last week would confirm the continuation of tight labor conditions that certain FOMC members stressed as private payrolls increased on a month-over-month basis by 497,000, a figure that would be more than 262,000 over consensus and 219,000 over the prior month. The stock market did not take kindly to this news as a hot jobs report, as this was, is undesirable when aggressive monetary tightening policies are in place as it can become increasingly challenging for the central bank to strike a balance between controlling inflation and maintaining sustainable economic growth. However, these concerns would be quickly put to rest when the Bureau of Labor Statistics (BLS) released its monthly employment figures that contradicted ADP’s report last Friday. According to the BLS, nonfarm payrolls increased by just 209,000 monthly, below the 213,000 consensus and the 339,000 May reading. The unemployment rate fell slightly from 3.7% to 3.6%. However, this range was expected, and the participation rate remained unchanged at 62.6%. It should also be noted that the Fed forecasts the unemployment rate to rise to 4.1% by the end of 2023. Private payrolls, which the ADP report focuses on, increased by just 149,000 in the BLS report, far lower than the 199,000 expectation.

With the jobs data coming in mixed, this upcoming week’s consumer price index (CPI) and producer price index (PPI) inflation readings this week will provide more predictability as to whether the Fed will end its rate hiking pause at the end of the month or extend it further. Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

ADP Employment Statistics as of 7/5/2023. Employment data sourced from the Bureau of Labor Statistics on 7/7/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 7/7/23. Economic Calendar Data from Econoday as of 7/7/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.