Last Week’s Markets in Review: More Stimulus On-Deck

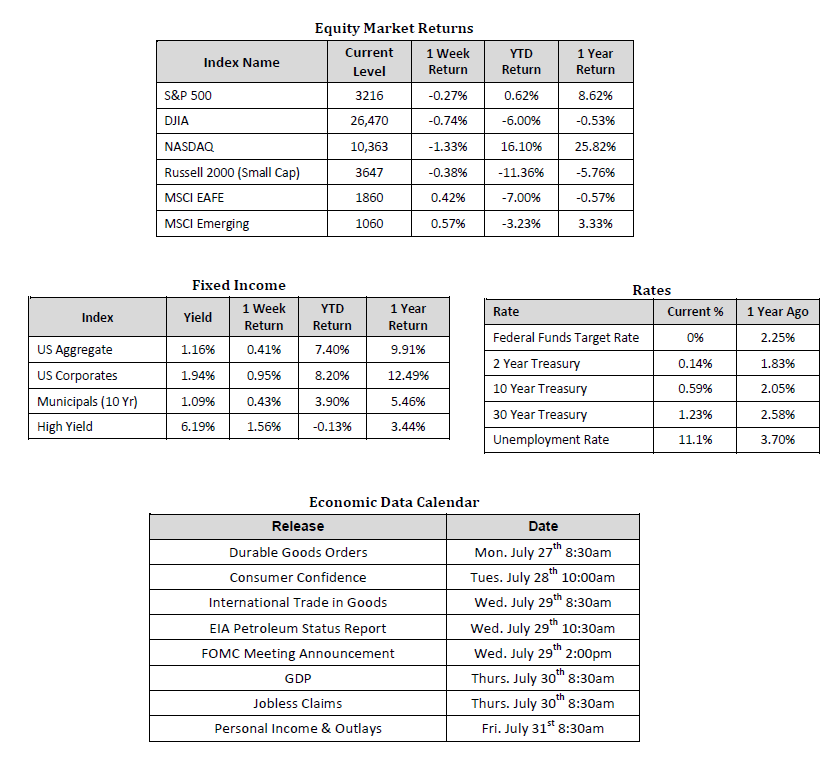

Stocks wavered in another volatile week of trading. Earnings updates, economic stimulus news, and renewed concerns over continued geopolitical tensions influenced markets. In the U.S., the S&P 500 Index fell to a level of 3,216, representing a loss of 0.27%, while the Russell Midcap Index moved 0.22% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.38%. International equities were able to gain ground as developed and emerging markets returned 0.42% and 0.57%, respectively. Finally, the yield on the 10-year U.S. Treasury moved lower finishing the week at 0.59%, down 5 basis points from the week prior.

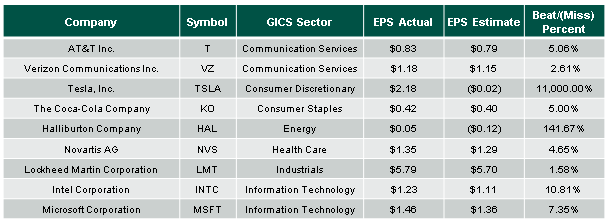

Last week featured a full slate of earnings reports covering the second quarter of 2020. Even though expectations were abysmal due to the economic impact of COVID-19, investors eagerly awaited to see if companies could continue the positive momentum from the week prior. In large part, investors were not disappointed. Below is a sampling of some of the more prominent company’s earnings per share (EPS) releases compared to consensus expectations.

Source: Bloomberg

Recognizing that we’re still in the early innings of the second-quarter earnings season, it looks possible that S&P 500 companies may outperform the initial 44% earnings decline expected from Wall Street. According to FactSet, as of July 24, 2020, with 26% of the companies in the S&P 500 reporting actual results, 81% of S&P 500 companies have reported a positive EPS surprise and 71% have reported a positive revenue surprise for the second quarter of 2020. Still, the road to a full economic recovery will be a long one, and the forward guidance provided by a company during earnings releases and calls may prove more critical than top or bottom line beats or misses. Let’s also not forget the smaller capitalized publically traded companies. Consensus estimates for Russell 2000 company earnings were for more than an 85% drop as many small, local businesses, which represent a major component of the U.S. economy, continue to struggle.

Shifting gears from earnings, global stimulus measures made headlines last week. Big news came out of Europe as European Union (EU) leaders agreed to a plan that would put to work roughly $2 trillion to help support the economies of member countries. At a high level, the EU will create a recovery fund of approximately $858 billion through low-interest loans and grants, while leaders also agreed to create a new EU budget of nearly $1.3 trillion. We’ve seen what historic levels of stimulus in the U.S. have done to help support the U.S. economy and stabilize the U.S. markets during the pandemic thus far, so this is welcomed news that the 27 member nations were able to come to an agreement to support their respective economies, and in turn, global capital markets.

Moving back to our homefront, the U.S. appears to be on the way to an additional round stimulus as well. Senate Republicans and the White House have agreed on a relief package worth around $1 trillion. Although there remain several open items, pundits consider progress thus far a big step forward. The CARES Act is set to expire at the end of the month so Americans will have to wait and see what programs may, or may not, be extended, such as the enhanced unemployment benefits that have helped support the record number of citizens that have filed for unemployment since the onset of COVID-19.

We continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, time-frame, and tolerance for risk.

We recognize that these are very troubling and uncertain times and we want you to know that we are always here for you to help in any way that we can. Please stay safe and stay well.

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 7/24/20. Rates and Economic Calendar Data from Bloomberg as of 7/24/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid-cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.