Last Week’s Markets in Review: Municipal Bonds Looking More and More Attractive

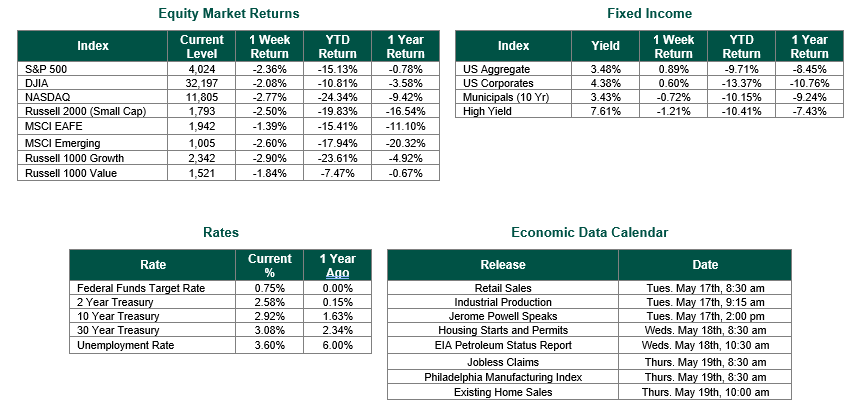

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,024, representing a decline of 2.36%, while the Russell Midcap Index moved 1.60% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.50% over the week. As developed, international equity performance was lower, and emerging markets returned -1.39% and -2.60%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 2.92%.

While we have written numerous times about the importance of time in the market vs. trying to time the market, the emotional aspect of behavioral finance can find it nearly impossible to resist wondering how to time today’s markets. Resisting this temptation can be particularly difficult when considering the selloffs in the S&P 500 and Barclays Aggregate Bond Indexes of -15.13% and -9.71%, respectively, so far in 2022. As a result, it is natural for investors to ponder when the right time might be to access different asset classes, given the discount in prices. While we certainly do not have a crystal ball to suggest how much farther markets will fall, we may be able to shed some light on one specific asset class, which is an area of particular expertise for Hennion and Walsh: Municipal Bonds.

As a means of background, municipal bonds are issued by state and local governments to raise money for major capital projects such as the building of infrastructure like bridges, roads, hospitals, schools, sewer systems, stadiums, airports, power plants, and prisons, or to provide for other needs of local government. As a general rule, interest income is exempt from state and local taxes if the investor lives in the same state as the bond issuer. For example, a New Jersey resident owning a New Jersey State municipal bond would not have to pay federal or state taxes on the interest received from this bond.

As of this writing, the municipal bond market, as measured by the Barclays Municipal Bond Index, has fallen by -10.15% year to date – the worst annual start on record. While this may be alarming to some investors, there may be a light at the end of the tunnel. To start, the overall credit health of the municipal market has not changed throughout this year. In August of 2019, Moody’s published a research report that showed that investment-grade rated municipal bonds had an average cumulative 10-year default rate of just 0.10% between 1970 and 2018. Contrary to perpetual investments like equities, municipal bonds trade with a maturity or call date in which 100 cents on the dollar will be paid back to investors at a point in time in the future, assuming no default before that scheduled date. This feature means that even if investors of municipal bonds have seen 10%+ declines in the prices of their investment-grade municipal bonds, they can still expect recovery to par at maturity, or call date, as they had planned when purchasing them with approximately 99.90% certainty (this assumes the Moody’s research is constant).

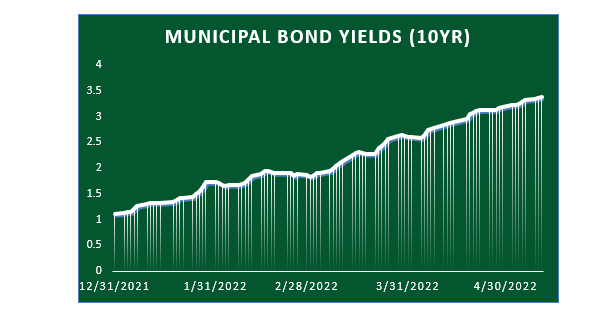

For investors wondering if municipal bonds, or municipal bond-oriented strategies, are more attractive at current levels and worthy of additional investment contemplation, consider the following. The recent selloff in municipal bonds has seen their associated yields jump from 1.12% to 3.38% since the start of the year as measured by the 10-year Barclays Municipal Bond Index, a yield to worst measure. These statistics mean that investors buying municipals can now potentially generate more than double their return compared to just five months ago. To put these yields into perspective, the 20-year average municipal bond yield has been approximately 3.01%, meaning that buyers of municipal bonds in today’s market are getting more than 35 basis points more in yield than on average.

Purchasers of the above-average rates have welcomed the recent surge in yields for municipal bonds, but the party may not last long. Due to their relatively limited quantities, the prices of municipal bonds are heavily influenced by supply and demand. Over the past few months, the selloff due to concerns over rising interest rates and increased inflationary pressure has opened the door for municipal buyers to reenter the “oversold” market. Over the past week alone, according to Electronic Municipal Market Access (EMMA), the municipal bond market has seen 20% more purchasers of bonds vs. sellers. As the limited supplies diminish due to the demand for higher yields, we may not expect these high rates to last for long.

If you are concerned with the recent municipal bond or the overall stock market activity, now may be the optimal time to review your portfolio with a financial professional to help ensure that your investments are sufficiently diversified and allocated towards the appropriate asset classes associated with your specific financial objectives, risk tolerance, investment horizon, and liquidity needs.

Best wishes for the week ahead!

Chart sourced from Bloomberg data on 5/13/2022. Municipal Bond trading activity data sourced from EMMA.MSRB on 5/13/2022. Moody’s research Source: Moody’s Investor Service, August 6, 2019 “US Municipal Bond Defaults and Recoveries, 1970–2018.” Equity Market and Fixed Income returns are from JP Morgan as of 5/13/22. Rates and Economic Calendar Data from Bloomberg as of 5/13/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.