Last Week’s Markets in Review: New Jobs and Oil Data Impact Markets

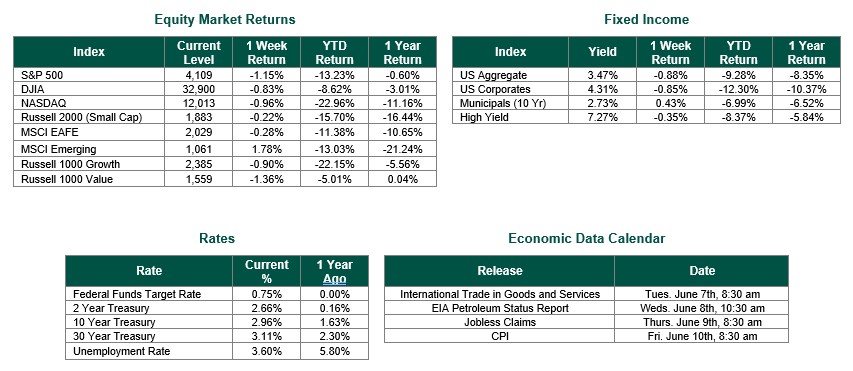

Global equity markets finished slightly lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,109, representing a decline of 1.15%, while the Russell Midcap Index moved 1.20% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.22% over the week. As developed, international equity performance was slightly lower, and emerging markets were higher returning -0.28% and 1.78%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 2.96%.

In the shortened week after the Memorial Day Holiday, markets continued to move in reaction to economic data. Market participants added the newly released data into both their inflation analysis and their opinions about potential upcoming Fed policy. The economic data included the May Consumer Confidence Index, the results of an OPEC meeting, a reading of U.S. crude oil inventories and most importantly the May employment report.

On Tuesday the Conference Board released its consumer confidence survey results for May. The index fell to 106.4. Despite consumers’ somewhat unfavorable perceptions, unemployment remains low, with the Conference Board noting that, “they do expect labor market conditions to remain relatively strong, which should continue to support confidence in the short run”.

Global oil supplies were in focus on Thursday as Saudi Arabia and other OPEC+ states agreed to increase oil production to offset the cuts imposed by many countries on Russian imports. OPEC+ agreed to raise output to approximately 650,000 barrels per day in the next two months. The 650,000 barrels represented a meaningful increase over the previously announced 432,000 barrels per day. This positive news was countered by a larger than expected drawdown in U.S. crude oil stockpiles. The EIA Petroleum Status report for the week ending May 27th showed a drawdown of 5.1 million barrels, compared with analysts’ expectations for a drop of just 1.3 million barrels.

The labor market stayed strong in May. This was evident from information contained in the Bureau of Labor Statistics report released on Friday. The U.S. economy added 390,000 jobs in May. This was stronger than the consensus estimate of 328,000. The unemployment rate for May was 3.6%. The unemployment rate was unchanged from April and remains near the 50-year low of 3.5% that was reached prior to the onset of the COVID-19 Pandemic. The only cloud lingering over the jobs market now that we see for employers now is filling open positions as there are approximately two job openings for every one unemployed American.

The strong jobs report confirmed the belief by many market participants that the Fed to proceed with the two 50 basis point increases to the Federal Funds Target Rate that Chairman Powell earlier signaled for the upcoming June and July Federal Open Market Committee (FOMC) meetings. As a result, equities sold off and Treasury yields rose to finish the week on Friday.

Investors should consider all of the information discussed within this market update and many other factors. However, with so much data and so little time to digest it all, we encourage investors to work with experienced financial professionals to help process all of this information in order to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Consumer Confidence Index data is sourced from the May Survey from the Conference Board. Data for U.S. crude inventories are sourced from the U.S. Energy Information Administration. Employment data is sourced from the Bureau of Labor Statistics. Equity Market and Fixed Income returns are from JP Morgan as of 6/3/22. Rates and Economic Calendar Data from Bloomberg as of 6/3/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.