Last Week’s Markets in Review: Oil Prices Push Inflation Up & Markets Down

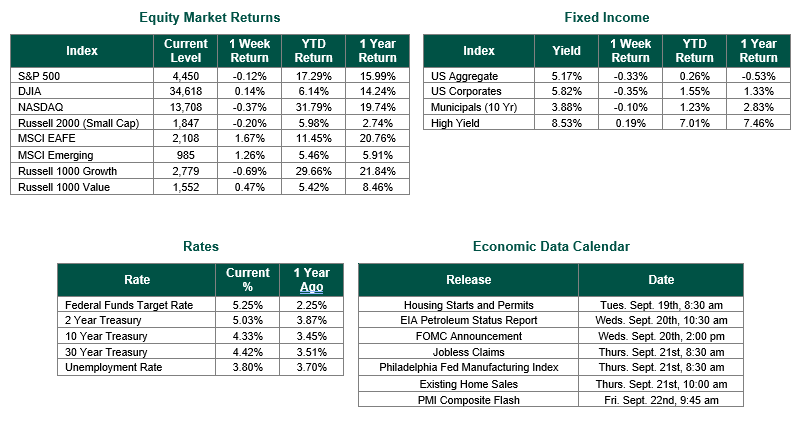

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,450, representing a loss of 0.12%, while the Russell Midcap Index moved -0.90% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.20% over the week. As developed international equity performance and emerging markets were higher, returning 1.67% and 1.26%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.33%.

Oil prices last week hit their highest levels in 2023 when Brent and WTI traded at $93 and $90 per barrel, respectively. The third consecutive weekly rise in oil prices comes as Saudi Arabia and Russia announced cuts to their daily production by 1,000,000 barrels and 300,000 barrels through the year’s end. These cuts could create a global supply shortage in the fourth quarter, leading to potential further price appreciation in the commodity.

The rise in oil prices comes at an inopportune time in which monetary policies have been fighting inflation, of which oil has a significant influence. Within August’s recent disappointing Consumer Price Index (CPI) reading that saw a 3.7% year-over-year increase, energy prices rose by 5.6%. While often one of the more volatile pieces of the CPI equation, oil prices have one of the more direct impacts on consumers. If these higher oil prices continue to climb or remain elevated, this could cause a significant global impact on consumer spending. Additionally, concerns have now grown that if energy prices continue to prevent inflation from declining to central banks desired levels, then rates could stay higher for longer, and economic growth could slow further.

Producer prices were also released last week and were higher than expected at 0.7% in August vs. 0.4% consensus. Markets did not take well to the two inflation reports, which damped investor confidence ahead of this week’s decision about interest rates at the Federal Open Market Committee (FOMC) meeting. It is important to note that the data points and recent market reaction have not influenced the futures market. As it stands now, according to CME Group, the probability of no rate hikes by the Federal Reserve this week stands at 97%, which is above the 92% probability from a week ago.

Consumer Price Index and Producer Price Index data from the Bureau of Labor Statistics on 9/13/23 and 9/14/23, respectively. Equity Market, Fixed Income returns, Commodity Prices, and rates are from Bloomberg as of 9/15/23. Economic Calendar Data from Econoday as of 9/15/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.