Last Week’s Markets in Review: Omicron News Leads to Market Volatility

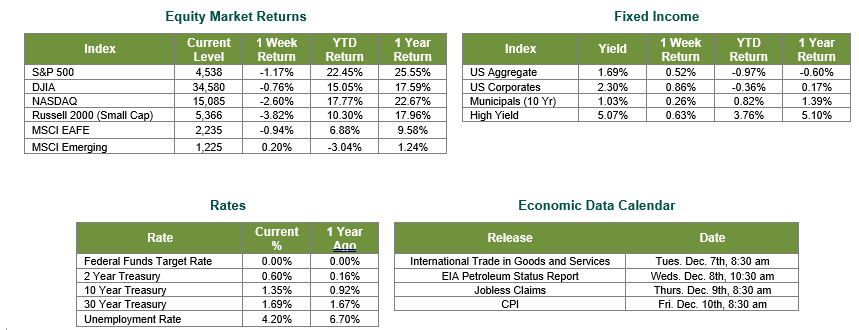

Global equity markets finished mostly lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,538, representing a decline of 1.17%, while the Russell Midcap Index moved 1.71% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -3.82% over the week. International equity performance was mixed as developed, and emerging markets returned -0.94% and 0.20%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 1.35%.

This week’s update discusses the initial effects of the recently announced variant of the COVID-19 Virus, Omicron. Throughout the past week, ongoing developments, media coverage, and the market’s reaction concerning Omicron have dominated the headlines while overshadowing other important developments during the week.

The Omicron variant created market volatility from the moment it was announced, as our readers will likely recall the meaningful market move lower on Friday, November 26. Throughout the past week, markets experienced rallies and declines within the same trading session. As an example, the S&P 500 opened the December 1st trading session at 4,602.82. Over the course of the day, the index traded as high as 1.08% and as low as -2.01% from that opening level. The index closed at 4,513.04, representing a decline of 1.95%. We believe that the markets will likely continue to experience more short-term bouts of volatility until more is known about the Omicron variant itself, the government’s response to the variant, and the potential impact on the overall economy.

As eluded to earlier, other important developments last week went largely underreported. For example, on Thursday, the U.S. Department of Labor reported 222,000 in initial jobless claims for the week ended November 27. This result was below the expected number of 240,000. Continuing claims for the week ended November 20 totaled 1.956 million, representing a new low since the pandemic began in March 2020.

Additional employment stats were released on Friday. Reports from the U.S. Department of Labor (DOL) showed that total non-farm payroll employment rose by 210,000 in November, and the unemployment rate fell by 0.4 % to 4.2%. This was a mixed report when compared to Wall Street expectations. The non-farm payroll employment figure fell well short of the consensus estimate for job growth of 546,000 new jobs. Conversely, the 4.2% level of unemployment marked a pandemic low, moving closer to the pre-pandemic level of 3.5% that Federal Reserve Chair Powell has continued to reference. We will continue to provide updates on employment as we believe it is a major component of how Chair Powell and the Federal Reserve will implement its “TNT” (Taper, Narrow, and Tighten) program over the coming months and years.

Lastly, President Biden signed a short-term spending bill to avoid a government shutdown on Friday. The bill provides for funding for the Federal government through February 18, 2022.

Investors should consider all information and data discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest it all, we encourage investors to work with experienced financial professionals to help process all of this information in order to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and risk tolerance.

Best wishes for the week ahead!

Employment data is sourced from the U.S. Department of Labor. Equity Market and Fixed Income returns are from JP Morgan as of 12/3/21. Rates and Economic Calendar Data from Bloomberg as of 12/3/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.