Last Week’s Markets in Review: Q1 Earnings & Economic Data in Focus

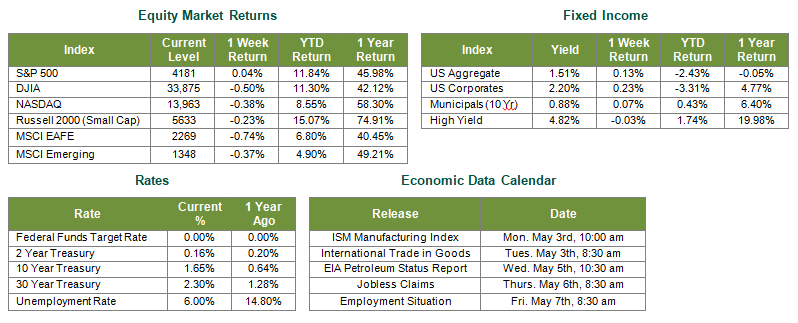

Global equity markets were mixed on the week, with U.S. equities leading international equities. In the U.S., the S&P 500 Index rose to a level of 4,181, representing a 0.04% gain, while the Russell Midcap moved in the other direction, depreciating 0.35%. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, moved 0.23% lower over the week. Moreover, developed international markets moved 0.74% lower, while emerging markets fell 0.37%. Finally, the 10-year U.S. Treasury moved to 1.65%, seven basis points higher than the prior week.

It was a busy week in economic and earnings news as a plethora of favorable data points were released. Initial first-quarter earnings announcements have shown overwhelmingly positive revenue and earnings growth. Moreover, economic data points such as consumer confidence, Fed interest rate policy, Gross Domestic Product (GDP), and jobless claims all continued to point to a healthy and robust American consumer and economic recovery. Now, let’s dive into some of the economic results investors paid particular attention to over the prior week.

On Tuesday, consumer confidence showed a continued upward trajectory, with reported results registering nearly 10% higher than consensus expectations initially called for. As a reminder, consumption makes up approximately 70% of Gross Domestic Product (GDP), so a confident consumer is critically important to the vitality of the U.S. economy. Moving on to Wednesday, investors hung on every word of Federal Reserve Chairman Jerome Powell’s quarterly remarks, paying specific attention to any change in phrasing that might potentially indicate a sudden change in interest rate policy. However, no such shift in wording materialized, and Chair Powell reaffirmed the Federal Reserve’s commitment to maintaining record low interest rates and sustaining an aggressive quantitative easing regime until “substantial” progress is made on the employment front. And finally, on Thursday of last week, first-quarter GDP numbers reinforced the consumer’s confident stance as the economy grew at a 6.4% annualized rate on a quarter over quarter basis. While this result came in below consensus expectations looking for a 6.7% growth rate, it was still encouraging. Moreover, personal consumption expenditures showed a 10.7% increase! Pretty remarkable indeed, but it is important to remember that a lot of the underlying growth figures are relative to the economically damaging, beginning stages of the COVID-19 pandemic in 2020.

In addition to a general persistence in positive economic releases, initial 1st quarter revenue and earnings figures did not disappoint. In fact, as of Friday’s close of business, 60% of S&P 500 constituents had reported first-quarter revenue and earnings results. Of the companies that have reported results, 86% reported a positive Earnings-Per-Share (EPS) surprise, and 74% have reported a positive revenue surprise. Keep in mind, by many estimates, earnings and revenue expectations for the first quarter reflected an optimistic outlook, so to see so many companies beating those already optimistic expectations is fantastic. Also worth noting, according to FactSet, is that “if 86% is the final percentage for the quarter, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.”

By now, it’s no secret that we’re bullish on the U.S. economy and U.S. stocks, in general, but we also recognize that short-term bouts of elevated volatility may lay ahead. From our experience, the most effective way to help mitigate the uncomfortable effects of elevated volatility is to maintain a properly diversified portfolio structured to meet each investor’s specific needs. With that said, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, time-frame, and risk tolerance.

Best wishes to all for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 4/30/21. Rates and Economic Calendar Data from Bloomberg as of 4/30/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.