Rates Unchanged, Unemployment Rises

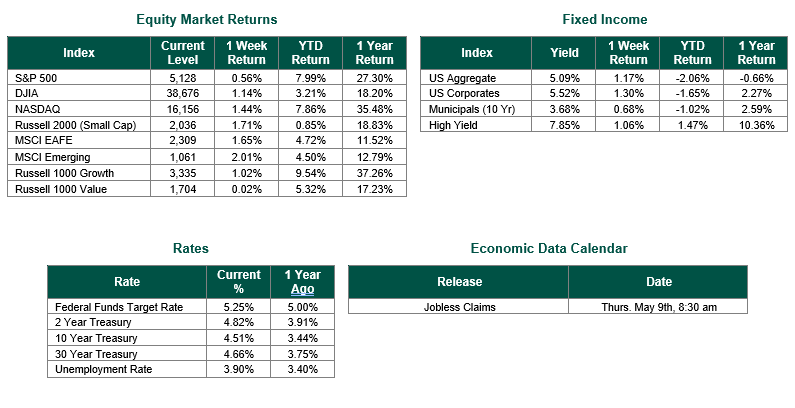

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,120, representing an increase of 0.56%, while the Russell Midcap Index moved 0.88% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.71% over the Week. As developed international equity performance and emerging markets were higher, returning 1.65% and 2.01%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.51%.

Fed Chair Jerome Powell recognized recent setbacks in its fight against inflation but signaled a preference for maintaining current interest rates for an extended period rather than considering further increases. At their Wednesday meeting, officials opted to keep the benchmark federal-funds rate steady at a range between 5.25% and 5.5%, the highest in two decades.

Powell expressed a cautious outlook, indicating it might take longer to regain confidence in a sustained path towards lower inflation. While he anticipated a decline in inflation this year, he admitted his confidence in that outcome had waned. To consider rate hikes, the Fed would require convincing evidence that higher interest rates weren’t curbing inflation, a scenario not yet evident in the data.

Before the meeting, market jitters prevailed over speculation regarding potential rate hikes. Though Powell suggested rate hikes were improbable, market reactions remained volatile, reflecting uncertainty. The Fed also approved plans to slow the ongoing reduction of its $7.4 trillion asset portfolio, extending pandemic stimulus measures initiated four years ago.

The Fed’s rapid rate increases from near-zero levels aimed to combat inflation, which soared to a 40-year high. However, higher rates have impacted various sectors, including housing and manufacturing, prompting concerns about the need for policy adjustments. Powell’s reluctance to entertain significant policy shifts surprised some analysts, who expected more flexibility given recent economic challenges.

Despite inflationary pressures, Powell maintained a view that a rate cut is more likely than an increase. He emphasized the need for more substantial evidence before considering rate hikes, outlining scenarios where rate cuts could be warranted, such as unexpected weakness in the labor market or a resumption of declining inflation.

The Fed’s balancing act reflects the challenges of navigating between inflation risks and economic stability. The recent labor market report, showing slowed job growth and a slight uptick in unemployment, adds to the ongoing debate about the economy’s health. Powell reiterated the Fed’s commitment to monitoring inflation and indicated a readiness to respond to unexpected labor market weaknesses with rate adjustments. Whether the recent weakness in the jobs market is enough to move the scale for the Federal Reserve remains to be seen.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 5/3/24. Economic Calendar Data from Econoday as of 5/6/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.