Last Week’s Markets in Review: Reflecting on 2021 & Preparing for 2022

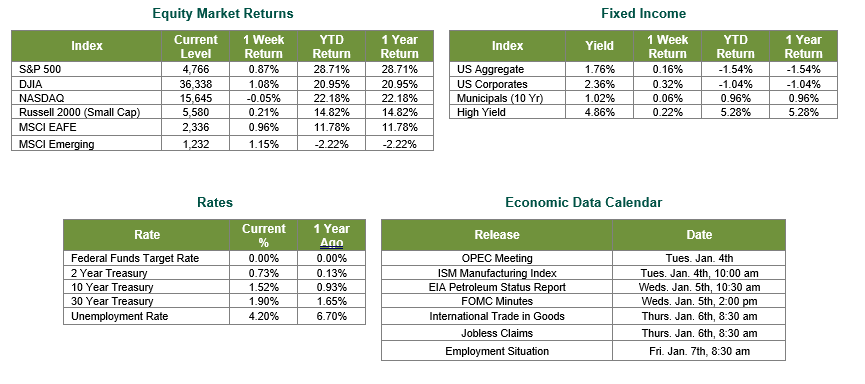

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,766, representing a gain of 0.87%, while the Russell Midcap Index moved 1.51% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.02% over the week. International equity performance was higher as developed, and emerging markets returned 0.96% and 1.15%, respectively. Finally, the 10-year U.S. Treasury yield increased, closing the week at 1.52%.

As we close out 2021, we should all take time to reflect on the unimaginable year it has been. Heading into the year, optimism appeared to be prevalent across markets. Expectations for pandemic relief through vaccinations were on the horizon, and the promise of global economic recovery seemed to be inevitable. Elections had passed in the United States, creating a clearer vision of future expectations within our borders, and optimism amongst investors appeared strong as it was believed that fiscal stimulus matched with a supportive Federal Reserve would allow for growth across our markets. If only we knew now what we didn’t know then. In this week’s market update, we reflect on the many unexpected occurrences in 2021 that brought us to where we are today.

• January – Gross Domestic Product (GDP) Declined for the first time since the financial crisis.

• February – Global chip shortages crushed automaker production.

• March – Suez Canal blockage created major supply chain traffic.

• April – U.S. troops withdraw from Afghanistan after two decades of occupation.

• May – Cyberattacks cut U.S. gasoline supply, and the Consumer Price Index (CPI) jumps 4.2%.

• June – U.S. home prices see a 24% increase year over year.

• July – Delta variant of COVID-19 runs rampant and hampers the road to economic recovery.

• August – Chinese regulatory concerns and Evergrande shock emerging markets.

• September – FDA Approves COVID-19 vaccine boosters to help suppress virus variants.

• October – Oil surges above $80/barrel, and the economy slows to “just” 2% growth.

• November – The Federal Reserve announces its plan to begin tapering its bond purchases.

• December – Inflation hits a 39- year high, and the Omicron variant of COVID-19 spreads globally.

By reading through all of the various developments that occurred in 2021, it would seem surprising for us to say that U.S. markets finished the year up 28.71% and global markets ended the year up 19.02%, as measured by the S&P 500 and MSCI ACWI indexes, respectively. These returns are a testament to the resilience of consumers around the globe and the response of various governments to help support business activity.

So, where do we go from here? If there is anything that 2021 taught us, it is that uncertainty looms around almost every corner. While we plan for what may lie ahead in 2022, different obstacles will certainly cause the path to be adjusted. As we enter the near year, we highlight what we believe to be the Top 10 Investment Themes for 2022. And, as always, we continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, time-frame, and risk tolerance.

From all of us at Smart Trust®, we wish you a healthy and prosperous New Year!

Equity Market and Fixed Income returns are from JP Morgan as of 12/31/21. Rates and Economic Calendar Data from Bloomberg as of 12/31/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.