Retail Sales Point to Economic Resilience

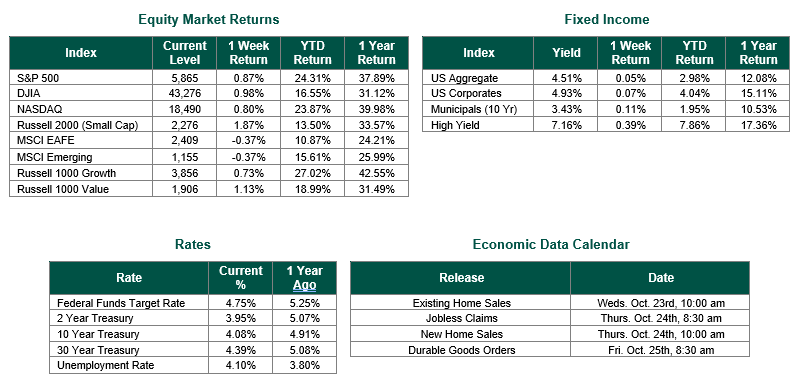

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 5865, representing an increase of 0.87%, while the Russell Midcap Index moved 0.66% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.87% over the week. As developed international equity performance and emerging markets were lower, returning -0.37% and -0.37%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.08%.

The U.S. economy continues to demonstrate its resilience, as evidenced by the latest economic data. Despite recent challenges, consumer spending and the labor market have remained relatively strong. Retail sales in September increased by 0.4%, indicating that consumers are maintaining their spending habits. This is particularly noteworthy given the economic uncertainties that have prevailed in recent months. The rise in retail sales suggests that consumers are still willing to spend, providing a much-needed boost to the economy, given that approximately 70% of gross domestic product (GDP) in the U.S. is attributable to consumer spending. However, all of this spending has also led to record levels of outstanding credit card debt. According to the Federal Reserve Bank of New York, credit card balances increased by $27 billion in the second quarter to reach a total of $1.14 trillion outstanding. In addition, over the last year, approximately 9.1% of credit card balances and 8.0% of auto loan balances transitioned into delinquency, again according to the Federal Reserve Bank of New York.

The labor market has also shown signs of relative strength. Initial unemployment claims declined, suggesting that fewer people are losing their jobs. This is a positive indicator for the overall health of the economy, as a strong labor market can help drive consumer spending and economic growth. The initial unemployment claims totaled 241,000 for the week, declining by 19,000 more than the estimated 260,000 by economists. On the flip side, it may be helpful also to note that the Federal Reserve updated their forecast for unemployment after the September FOMC meeting, suggesting that employment may end 2024 at 4.4% (their forecast was 4.0% in June) and fall slightly to 4.3% at the end of 2026 (their forecast was 4.1% in June).

While the overall economic outlook appears promising, there are still concerns about potential challenges. Inflation, although on a downward trajectory, remains a persistent issue. Additionally, there is a risk of a broader economic slowdown, both domestically and internationally, and fears over potential escalations of existing geopolitical conflicts.

Despite these uncertainties, the recent economic data suggests that the U.S. economy has remained resilient and is likely capable of weathering future challenges. As the Federal Reserve continues to implement its monetary policy and businesses and consumers adapt to changing economic conditions, the economy may be positioning itself for continued growth in the upcoming years.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 10/18/24. Retail Sales data from the Census Bureau on 10/17/24. Employment data was sourced from the Labor Department on 10/17/24. Economic Calendar Data from Econoday as of 10/21/24. The MSCI EAFE Index measures international developed markets, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.