Last Week’s Markets in Review: Santa Delivers Some Early Gifts in 2023

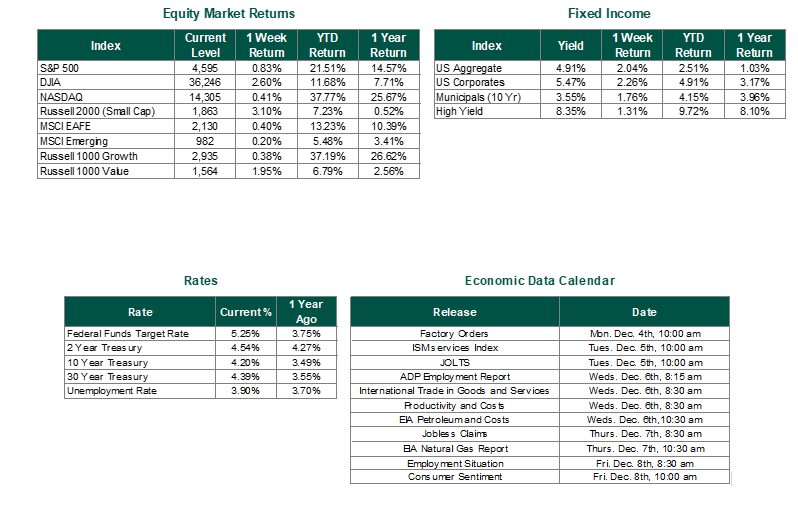

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,595, representing an increase of 0.83%, while the Russell Midcap Index moved 3.08% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.103% over the week. As developed international equity performance and emerging markets were higher, returning 0.40% and 0.20%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.20%. For the month of November, the S&P 500 rose by 8.72%, a much-welcomed relief to investors following a difficult three-month stretch for the markets between August – October.

After delivering record-breaking Black Friday sales that we reported last week, the U.S. consumer continued to spend aggressively with jaw-dropping online purchases on Cyber Monday. Despite rising prices, consumers spent $12.4 billion, according to Adobe Analytics, representing a year-over-year increase of 9.6%. In addition, throughout the 5-day shopping period between Thanksgiving and Cyber Monday, more than 200 million American consumers made purchases online and in stores, with an average of 55% of shopping driven by discounted products, according to the National Retail Federation. The increase in discounted price shopping of 52% that we witnessed last year could explain the demand from consumers during the early stage of the holiday shopping season.

Consumer spending over the holiday weekend was just the beginning of positive news for markets. Last Wednesday, the Commerce Department revision of third-quarter gross domestic product (GDP) showed that the U.S. economy grew at a 5.2% annualized pace, above the initial 4.9% reading and the Dow Jones consensus estimate of 5%. Contrary to the current consumer spending data we highlighted above, the revised figure was not driven by consumers, which actually had a downward revised total of 3.6% vs. the earlier 4% total that was reported, but, instead, much of the amended growth was produced by government spending and nonresidential fixed investment, rising 5.5% and 1.3%, respectively. It should be noted, however, that the current GDPNow estimate from the Federal Reserve Bank of Atlanta forecasts a GDP growth rate of just 1.2% for the fourth quarter of 2023 – representing a significant slowdown from Q3.

The Commerce Department also provided further positive data last week when it reported that the personal consumption expenditures price index (PCE), the Fed’s preferred measuring tool of inflation, rose at just a 0.2% month-over-month pace and 3.5% on a year-over-year basis, both in line with consensus. The data confirmed to the market that it would be highly unlikely that the Fed would increase interest rates at the December meeting and that we have more than likely reached the end of this rate hike cycle.

An ode to the late and respected Charlie Munger, who passed away last week: “Live within your income and save so that you can invest. Learn what you need to learn.”

Best wishes for the week ahead!

GDP and PCE data sourced from the Commerce Department on 11/27/23. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 12/1/23. Economic Calendar Data from Econoday as of 12/4/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.