Last Week’s Markets in Review: September Begins with More Fed Watching

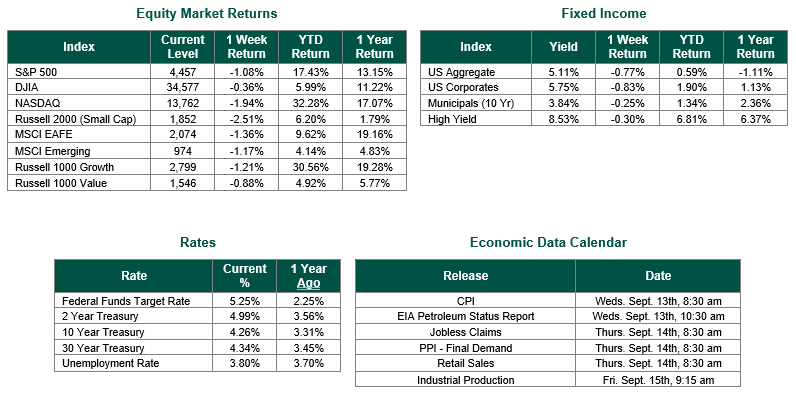

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4457, representing a decrease of 1.08%, while the Russell Midcap Index moved -2.04% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.51% over the week. As developed international equity performance and emerging markets were lower, returning -1.36% and -1.17%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.26%.

As we remember the tragic events on this date twenty-two years ago, we honor the individuals who lost their lives on that day and the many emergency personnel who have succumbed to illnesses related to the rescue and recovery efforts in the aftermath of the terrorist attacks. We will never forget.

The holiday-shortened week and the lack of fresh economic data left market strategists focusing on the upcoming Federal Reserve Meeting from September 19th – 20th. The focus on monetary policy was aided by a few data points and recent comments made by Fed Governors.

On Tuesday, the U.S. Census Bureau released the Factory Orders update for July. New orders for manufactured goods decreased by 2.1% from the previous month. This outcome was less than the consensus estimate of a decline of 2.5% and followed four consecutive months of increases in factory orders.

On Wednesday, market participants digested comments made by Boston Fed President Susan Collins and the release of the Fed’s “Beige Book” for July. During her speech, Collins stated, “The risk of inflation staying higher for longer must now be weighed against the risk that an overly restrictive stance of monetary policy will lead to a greater slowdown in activity than is needed to restore price stability.” Collins also said, “This context calls for a patient and careful, but deliberate, approach to policy, allowing time to assess the effects of policy actions to date, and then acting appropriately.”

The national summary of economic activity from the “Beige Book” indicated that economic growth was modest during July and August. Consumer spending on tourism was stronger than expected, surging during the last stage of pent-up demand for leisure travel from the pandemic era. But other retail spending continued to slow, especially on non-essential items. The regional Federal Reserve Banks reported that job growth was subdued across the Nation. Though hiring slowed, most of the regional Fed Banks indicated that imbalances persisted in the labor market as the availability of skilled workers and the number of applicants remained constrained.

Collins’ more dovish comments were supported by New York Federal Reserve Bank President John Williams and Atlanta Federal Reserve Bank President Raphael Bostic in speeches given on Thursday. Williams stated concerning current monetary policy, “Falling inflation and a better-balanced economy suggests that there is no urgency for a rate rise later this month.”

Whether the Fed hikes one more time this year or July’s hike represented the last hike of this rate hike cycle, it is clear to us that we will now shift to the discussion of rate cuts, as opposed to rate hikes, over the next two years.

We hope all our readers will join us in remembering the brave Americans who suffered a great loss on 9/11/01.

Best wishes for the week ahead.

Factory Order data was sourced from the U.S. Census Bureau. Comments and Beige Book data were sourced from the Federal Reserve Bank. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 9/8/23. Economic Calendar Data from Econoday as of 9/8/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.