Last Week’s Markets in Review: Shorter Term Yields Continue to Rise

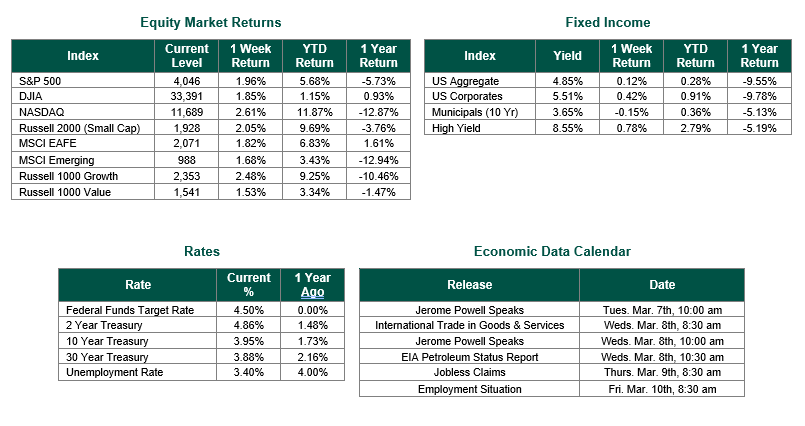

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,046, representing a gain of 1.96%, while the Russell Midcap Index moved 1.49% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.05% over the week. As developed, international equity performance and emerging markets were also higher, returning 1.82% and 1.68%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly higher, closing the week at 3.95%.

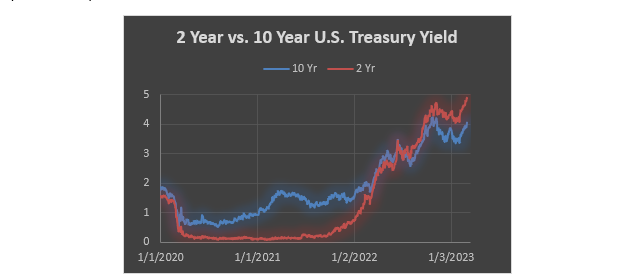

When the Federal Reserve hinted at raising rates back in 2022, inflation started its rampant run, concerns over an economic recession flooded headlines, and fixed-income markets took a downturn. For example, since August 2020, the 10-year treasury yield went from 0.52% to reach a tentative peak in October 2022 of 4.25% (and currently sits at 4.01% as of 3/1/23). These drastic rate moves are even more prominent on the shorter end of the yield curve (as seen in the yield chart below). Last Tuesday’s consumer confidence reading did not help rates either, as February’s reading registered 5.6 points below expectations. Additionally, Fed officials warned of a need to lift rates to a higher peak during their speeches this past week.

With rates at the highest levels since 2007, fixed-income buyers have been chomping at the ability to buy high-yielding short-term paper. One of the questions we often get is, “is this the best strategy?” While every investor is different, with varying levels of risk tolerance, investment objectives, and liquidity needs, there can be a valid case for fixed-income investors to consider looking beyond the appeal of short-term yields and extending the duration of their bond portfolios.

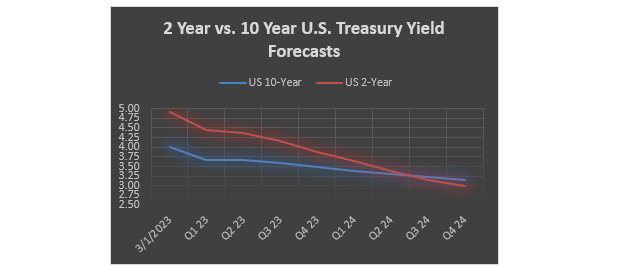

When looking at Bloomberg’s “BYFC” yield forecast tool, one can observe a significant reduction in yields across all levels of the curve looking out to the end of 2024. This implication is paramount for both short- and long-term investors in fixed income. On the short end of the curve, investors face reinvestment risk. While buying current short-term bonds, or other fixed yield instruments, is providing high returns now, when these securities mature in the near future, investors may find it difficult, if not impossible, to capture the same yield levels at equivalent levels of risk. Therefore, these investors will likely be forced to reinvest in lower yields, decrease credit quality, or extend duration if the yield curve expectations are correct and the slope of the curve is upward.

Contrary to the short-term investor, those willing to extend duration now may ultimately be rewarded later. As interest rates fall in the future, bonds with higher duration will have greater price appreciation. Accordingly, by buying longer duration now, investors could avoid the reinvestment risk by locking in higher yields over the long term while also getting the potential benefits from price appreciation as rates fall. It is important to remember the inverse relationship that exists between prices and yields with bonds. Typically, as yields rise, prices decline, and vice-versa. Of course, these considerations assume that the forecasts (and that is what they are – forecasts) for the yield curve prove correct. So does it make sense for investors to extend the duration of their bonds? The answer is not simple, as each investor will have different objectives within their fixed-income portfolios. However, given the current market conditions and the expectations going forward, it would be prudent for fixed-income market participants to discuss with their advisors what strategy may work best for their specific objectives.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and risk tolerance.

Best wishes for the week ahead!

Consumer Confidence data was sourced from the conference board on 2/28/23. Treasury market data and forward yield curve data from the U.S. Department of Treasury and Bloomberg, respectively, on 3/3/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 3/3/23.

Economic Calendar Data from Econoday as of 3/6/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.