Last Week’s Markets in Review: Slower Wage Growth Pushes Stocks Higher

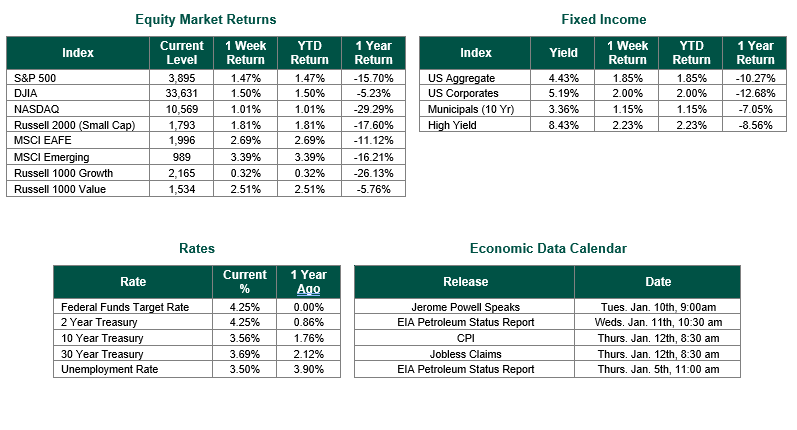

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,895, representing an increase of 1.47%, while the Russell Midcap Index moved 2.11% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.81% over the week. As developed, international equity performance and emerging markets were also higher returning 2.69% and 3.39%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.56%.

For our readers that have not done so already, we suggest reviewing our Top 10 Investment Themes for 2023. One of the themes, you will notice, is “Better Days Ahead Overall, but Some Bumpy Days are Anticipated” and the start of 2023 trading could not have provided a better example of such a forecast. Last week began with markets trading lower to start the new year before popping back up on positive job opening reports from the Labor Department. The JOLTS report showed 10.45 million current job openings, above consensus expectations looking for 10.1 million openings. The JOLTS, however, were not enough to keep markets stable as participant reaction to Federal Reserve minutes from the December FOMC meeting would convey a message of keeping rates higher for “sometime” and a reiteration of the importance of maintaining restrictive monetary policy to help combat inflation.

The bumpy days of 2023 would continue through the end of last week but would finish in positive fashion. Non-farm payrolls in December rose by 223,000, according to the U.S. Bureau of Labor Statistics, above consensus expectations of 200,000, but below the November reading of 256,000. The unemployment rate for the month fell 0.2% to 3.5% (also edging out consensus expectations), a number that was largely driven by an increase in the labor force participation rate.

Amidst all the important economic releases over the past week, the strongest reaction came from wage growth inflation. On a month-over-month basis, average hourly earnings rose 0.3% vs. expectations of 0.4% and 4.6% vs 5.0% on a year-over-year basis. The lower-than-expected wage growth paired with solid payroll increases hints that perhaps the Fed’s aggressive tightening policies have weakened inflation pressures without thus far being detrimental to the economy. This potential explanation, which we do not necessarily support, allowed markets to snap a 4-week losing streak and start 2023 in positive territory.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead, and Happy New Year again!

Economic data was sourced from the Department of Labor and The Bureau of Labor Statistics on 1/6/23. Equity Market and Fixed Income returns are from Bloomberg as of 1/6/23. Rates and Economic Calendar Data from Bloomberg as of 1/6/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.