Last Week’s Markets in Review: Soft Landing Hopes Push Dow to All-Time High

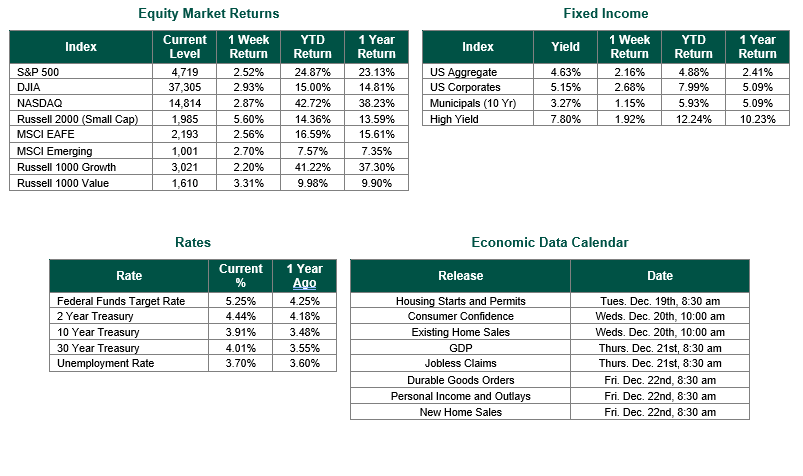

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index (S&P 500) closed the week at a level of 4,719, representing an increase of 2.52%, while the Russell Midcap Index moved 4.15% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 5.60% over the week. As developed international equity performance and emerging markets were higher, returning 2.56% and 2.70%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.91%.

The Federal Open Market Committee concluded 2023 by keeping a pause on interest rate activity after delivering four separate 25-basis point hikes throughout the year. The announcement was widely expected after recent lower inflation figures and higher unemployment data suggested that recent Fed actions are starting to impact the economy. For the first time in the current hiking cycle, the committee had somewhat dovish rhetoric by stating that “any” more policy tightening would require consideration of multiple factors, with the word “any” not appearing in any previous statements. Additionally, the updated Dot Plots point towards an expected 75 bps of cuts in 2024, above the previous projection of 50. The plots also suggested 100 bps of cuts in 2025 and another 75 bps in 2026, equating to a possible 250 bps (i.e., 2.50%) of rate cuts over the next three years.

The updated forecasts and commentary from the Fed helped drive equity markets higher last week. In particular, the Dow Jones Industrial Average index (Dow) reached an all-time high by crossing over the 37,000 plateau. The index had not surpassed a level of 36,952 since its previous all-time high was reached on January 5, 2022. Beyond the 30 stocks that represent the Dow Jones Index, the S&P 500 is now less than 2% away from reaching all-time highs itself, and the Nasdaq 100 index sits less than 8% from its highs also previously set in January of 2022.

Heading into 2023, there was great speculation amongst market participants about whether the Fed could create a soft landing for the economy after it aggressively raised interest rates in 2022 and significantly cut down the size of its balance sheet. As we stand in the year’s final weeks, there appears to be a greater likelihood of avoiding a recession, boosting investor sentiment. Despite the positive commentary, patience will be paramount during the remainder of this rate hike cycle. Although inflation has eased, it is still too high, and to get to a 2% target, interest rates will likely “stay higher for longer.” Overall, our outlook for lower rates, yields, and inflation over the next two to three years remains intact, creating opportunities in both stocks and bonds for investors to consider. However, we believe it prudent for individual investors to speak with financial professionals, especially as we head into 2024, to help ensure their investments are positioned according to their specific risk tolerances, time horizons, and objectives.

Best wishes for the week ahead, and Happy Holidays to all!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 12/15/23. Economic Calendar Data from Econoday as of 12/18/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.