Last Week’s Markets in Review: S&P 500 Hits All-time High

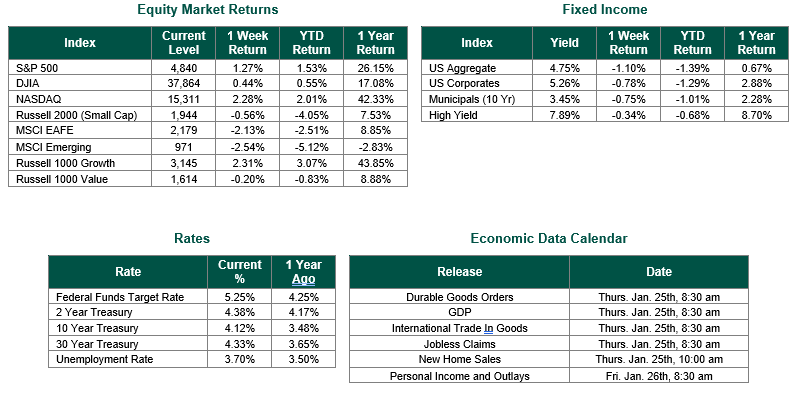

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 4,840, representing an increase of 1.27%, while the Russell Midcap Index moved -0.03% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.56% over the Week. As developed international equity performance and emerging markets were lower, returning -2.13% and -2.54%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.12%.

The past week saw the rally in equities continue, with both the Dow Jones Industrial Average and the S&P 500 Index achieving record levels on Friday, the latter eclipsing the record level last reached on January 3, 2022. It should be noted that the recent run for stocks has resulted in some stretched valuations as the price to earnings (P/E) ratio of the S&P 500 is now approximately 23.9. This upward movement occurred as markets digested favorable economic data throughout the week. These reports included retail sales for December, as reported by the Commerce Department, weekly jobless claims, and consumer sentiment, as reported by the University of Michigan. Fourth quarter earnings season has also begun with somewhat sluggish results.

Retail sales increased 0.6% during December, buoyed by a clothing and online (i.e., non-store) business pickup. The results were better than the 0.4% consensus estimate. The report demonstrates the strength of the consumer as we enter a new year where economic growth is expected to slow. A resilient consumer could signal more momentum and possibly give the Federal Reserve some caution about how to proceed with monetary policy.

On Thursday, the Labor Department reported that initial claims for unemployment benefits dropped 16,000 to a seasonally adjusted 187,000 for the week ending January 13. the lowest level since September 2022. The consensus estimate was for 207,000 initial claims.

The University of Michigan’s Survey of Consumers showed a reading of 78.8 for January, its highest level since July 2021 and up 21.4% from a year ago. The survey also found that the outlook for the inflation rate a year from now declined to 2.9%, down from 3.1% in December. The 2.9% inflation rate forecast is the lowest reading since December 2020.

At this early stage, the fourth quarter earnings season for the S&P 500 is off to a weak start. Thus far, 10% of the companies in the S&P 500 have reported results for the fourth quarter of 2023. Of these companies, 62% have reported actual EPS above consensus estimates, which trails the 5-year average of 77%. Regarding revenues, 62% of S&P 500 companies have reported actual revenues above estimates, below the 5-year average of 68%. Please continue to read this update in the coming weeks as we follow the results for the remaining 90% of the S&P 500 companies that have yet to report earnings.

Best wishes for the week ahead!

Retail Sales data is sourced from The Commerce Department. Initial Jobless Claims are sourced from the Labor Department. The University of Michigan Survey of Consumers is sourced from The University of Michigan. Quarterly earnings data is sourced from FactSet. Economic Calendar Data from Econoday as of 1/22/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.