Stocks Hit Record Highs as U.S. Inflation Eases

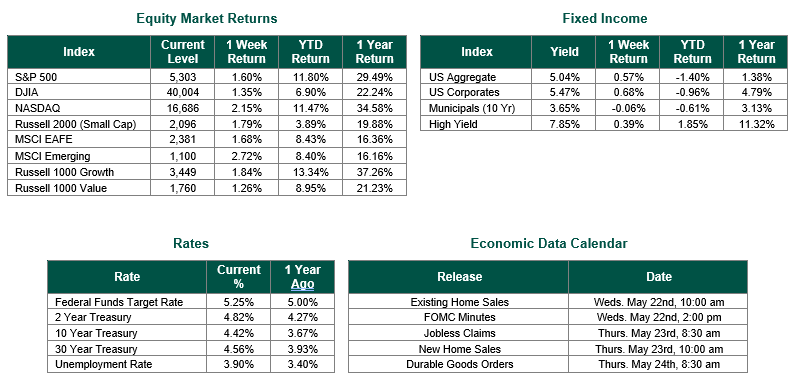

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,303, representing an increase of 1.60%, while the Russell Midcap Index moved 0.67% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.79% over the Week. As developed international equity performance and emerging markets were higher, returning 1.68% and 2.72%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.42%.

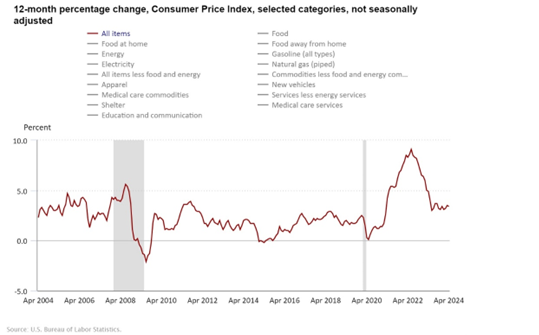

Market participants and the Federal Reserve were delighted to see that U.S. inflation eased slightly in April. The consumer-price index (CPI) rose 3.4% from a year ago, while core prices, excluding food and energy, increased by 3.6%, representing the smallest rise since April 2021. The report met expectations from economists and followed three months of higher-than-anticipated inflation readings. Following the release, all three major U.S. stock indexes hit record highs as the Nasdaq Composite rose 1.4%, the S&P 500 increased by 1.2%, and the Dow Jones Industrial Average climbed 0.9%. Additionally, 10-year U.S. Treasury yields fell to 4.354% as bond prices rose.

Inflation has moderated from last year, but many Americans still struggle with high prices, particularly for gasoline and housing. However, signs of relief include slowing rent increases and lower costs for groceries and vehicles.

Consumer sentiment also dropped sharply in May due to expectations of sustained high inflation and interest rates, impacting household budgets and mortgage rates. This drop follows April’s Consumer Confidence reading, which itself sank to 97 from a revised 103.1 result in March, marking its lowest level since July 2022. Consumer sentiment and confidence are critical as they have a direct impact on the economy, given that approximately 70% of gross domestic product (GDP) comes from consumer spending.

While Wednesday’s report alone will not prompt immediate rate cuts by the Fed, it maintains the high possibility of reductions later this year and almost completely tempers fears of a potential interest-rate hike. Fed Chair Jerome Powell has suggested patience, implying that more data is needed before making significant policy changes. Hence, rates are likely to stay “higher for longer.”

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 5/20/24. Economic Calendar Data from Econoday as of 5/20/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.