Last Week’s Markets in Review: Stocks Rise on GDP & Earnings Data

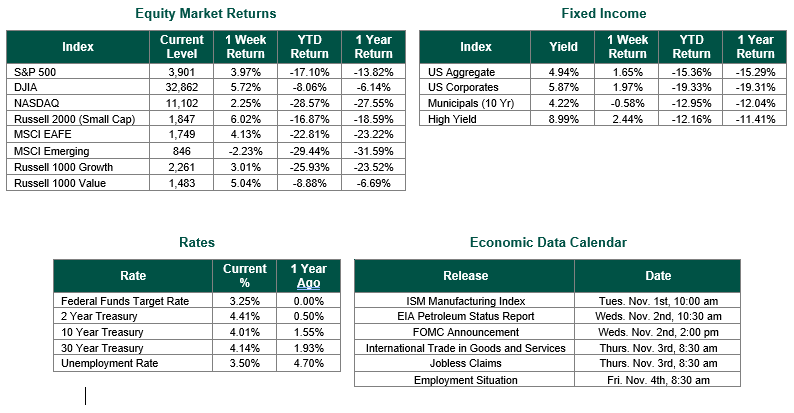

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,901, representing an increase of 3.97%, while the Russell Midcap Index moved 5.12% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 6.02% over the week. As developed, international equity performance and emerging markets were mixed returning 4.13% and -2.23%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.01%.

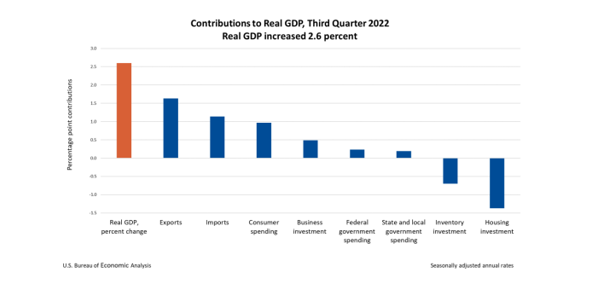

For the first time in 2022 the U.S economy delivered real positive growth at a 2.6% pace in the 3rd quarter. The better-than-consensus results would suggest, albeit for a moment, that market participants could be relieved of significant recession fears. Before jumping to any conclusions regarding the positive data, however, it would be prudent for us to dissect what is under the hood of these results.

Foremost, it is important to note that the 3rd quarter GDP report is an initial estimate that will be subject to further revisions later in 2022. According to the Bureau of Labor Statistics (BLS), the increase can be attributed to consumer spending, nonresidential fixed investment, and public sector spending. On the other hand, there were offsetting decreases within residential fixed investment and private inventory investment. Lastly, the balance of trade, a function of the GDP calculation that is represented by exports minus imports, added 2.77% to the headline with exports growth rising at a greater rate than the decrease in imports.

The market would initially react positively on Thursday following the release, before retracting later in the trading day. While the aggregate positive estimate of economic growth appears great on paper, there are some significant concerns from what was reported. Domestic final sales, which measures U.S. demand, rose at just 0.5% for the quarter, a near 71% drop-off from a year ago, and significantly below the long-term average of 3.24%. Consumer spending rose at just a 1.4% rate for the quarter which was below the 2% rate in Q2. This represents a declining trend consistent with what one would expect during an economic slowdown. Additionally, the real estate market took a major hit in the report as residential investment (I.e., home building) dropped 26.4%. While the trade balance was strong, we have concerns about the future prospects of this trend continuing given the relative strength of the U.S. dollar with its global trading partners.

There were few other noteworthy items last week. First, jobless claims for the week increased by 3,000 to 217,000. However, this result was below consensus expectations of 223,000. Durable goods orders increased by 0.4% in September, representing an increase from the August reading of 0.2%, but below consensus expectations looking for growth of 0.6%. Lastly, core PCE, the Federal Reserve’s preferred inflation gauging tool, rose 5.1% year over year, slightly below the 5.2% forecast in what appears to be a rare positive reading on inflation.

Checking in on Q3 2022 earnings, reports across industries were mixed throughout the week. Caterpillar reported positive results beating on the top and bottom lines with earnings per share (EPS) of $3.95 and revenue of $14.99 billion. Tech giants Apple and Microsoft also reported positive results with EPS of $1.29 and $2.35, respectively along with revenue of $90.15 billion and $50.12 billion, respectively. Contrarily, Meta Platforms had a significant miss on EPS, reporting $1.64 vs. a consensus estimate of $1.89. However, revenue beat with a reported total of $27.71 billion. Amazon, on the other hand, missed on revenue of $127.1 billion, but beat on the bottom line with EPS at 28 cents.

Investors should consider all the information discussed within this market update, as well as many other factors when managing their investment portfolios. However, with so much data and so little time to digest it all, we encourage investors to work with experienced financial professionals to help the first process all this information and then build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Happy Halloween and best wishes for the week ahead!

GDP and PCE data sourced from the Bureau of Economic Activity, Durable Goods Orders from the US Census. Weekly Jobless Claims were sourced from the Department of Labor. Third-quarter corporate earnings information is sourced from Refinitiv Equity Market and Fixed Income returns are from JP Morgan as of 10/28/22. Rates and Economic Calendar Data from Bloomberg as of 10/28/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.