Last Week’s Markets in Review: Strong Consumer Data Contributes to the Equity Rally

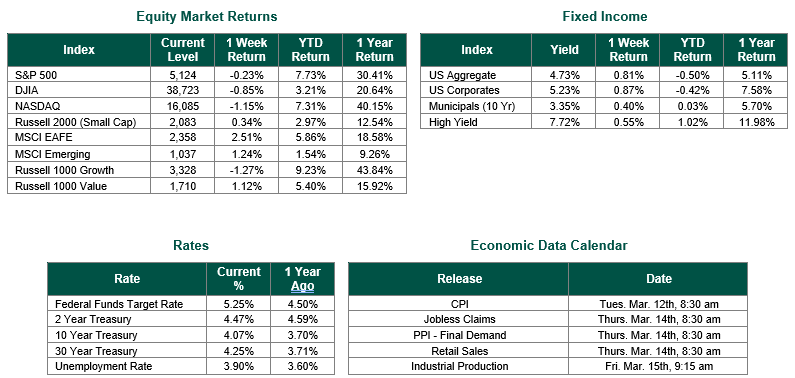

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,254, representing an increase of 0.26%, while the Russell Midcap Index moved 0.86% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.30% over the Week. As developed international equity performance and emerging markets were higher, returning 0.16% and 0.45%, respectively. Finally, the 10-year U.S. Treasury yield was unchanged, closing the Week at 4.20%.

In a trading week that was shortened in observance of the Easter holiday, the economic calendar was robust with new data. On Tuesday, the U.S. Census Bureau released the Durable Goods Orders for February with new orders increasing by 1.4% on a monthly basis, slightly better than the consensus estimate of 1.3%. Notably, this marked the first positive monthly result following two consecutive monthly decreases. Also on Tuesday, the markets received the latest data concerning Consumer Confidence. The Conference Board said that its consumer confidence index dipped to 104.7 in March, unchanged from the downwardly revised 104.8 in February. “Recession fears continued to trend downward,” stated Dana Peterson, chief economist at the Conference Board.

The most surprising data came form the third and final revision for fourth quarter GDP released on Thursday. Typically this data released by the Commerce Department is fairly predictable, that was not the case. Both GDP (3.4% revised up from 3.2%) and Personal Consumption Expenditures (3.3% revised up from 3.0%) were revised higher and exceeded the consensus. The unexpected growth was boosted by strong consumer spending and business investment in nonresidential structures like factories and healthcare facilities. Weekly jobless claims were also better than both the prior week and consensus estimates. When investors consider these two data points, the correlation between jobs and consumer spending cannot be questioned.

The final item that will be discussed in this Update will be Fed Chair Powell’s comments from his speech on Friday. “The latest U.S. Inflation data is along the lines of what we would like to see,” Powell said. The overall language from the speech would imply that the Fed’s baseline for interest rate cuts this year remains intact.

Best wishes for the week ahead, and we hope that Easter was a joyous day for all who celebrated.

Durable Goods data is sourced from the U. S. Densus Bureau. Consumer Confidence data is sourced from the Conference Board. GDP data is sourced from the Commerce Department. Economic Calendar Data from Econoday as of 3/28/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.