Last Week’s Markets in Review: Strong Jobs Market Continues to Confuse Investors

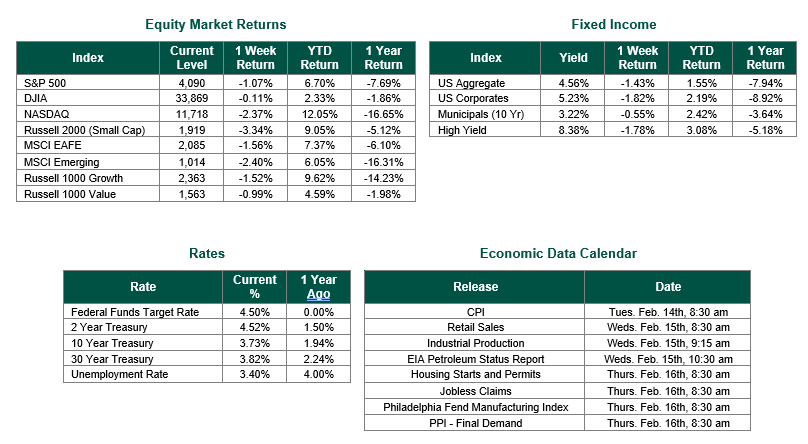

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4090, representing a decrease of 1.07%, while the Russell Midcap Index moved -1.19% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -3.34% over the week. As developed, international equity performance and emerging markets were lower returning -1.56% and -2.40%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.73%.

Most market participants spent last week analyzing the events of the week concerning January’s employment data that shocked the markets on February 3rd. That report, as a reminder to our readers, showed a highly unexpected increase in nonfarm payrolls of 517,000 (nearly triple the consensus estimate) and an unemployment rate of 3.4% (the lowest unemployment rate since May of 1969).

The first notable event of last week was an interview that Fed Chairman Powell gave at the Economic Club of Washington on Tuesday. Due to the unexpected nature of the January jobs report, market participants were laser-focused on this relatively light (from a policy perspective) interview of Chairman Powell. Powell mostly restated the FOMC’s position from his last press conference concerning future policy and the Fed’s ongoing fight against inflation. Chairman Powell did remark, “The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector, which is about a quarter of our economy, but it has a long way to go. These are the very early stages.” As was expected the Chairman did not indicate when the interest rate hikes will end and continued to state that future policy is data dependent. According to Powell, “The reality is we’re going to react to the data. So if we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in.”

More robust labor data was reported on Thursday. Weekly jobless claims totaled 196,000, an increase of 13,000 claims from the prior week. The four-week moving average of claims, which is considered to be a better measure of labor market trends, fell by 2,500 to 189,250. This average was the lowest level since last April. Adding to the market’s confusion concerning jobs, overall claims have remained low despite high-profile layoffs in the technology and financial industries.

The final data release that we intend to discuss this week is the University of Michigan’s Index of Consumer Sentiment for February, which was released on Friday. As our readers know, consumer spending is a highly important component of our economy, accounting for approximately 70% of the overall gross domestic product (GDP). The preliminary reading for February showed a reading of 66.4, the highest reading since January 2022 and up from 64.9 in the prior month. The sentiment index has rebounded from a low of 50.0 in June of 2022. The improvement in sentiment may have been driven by persistent labor market strength and the rally in the stock market in the early months of 2023.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Weekly Jobless Claims data is sourced from the Department of Labor. The index of consumer sentiment is sourced from the University of Michigan. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 2/10/23. Economic Calendar Data from Econoday as of 2/10/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.