Last Week’s Markets in Review: Taking a Hike with the Fed

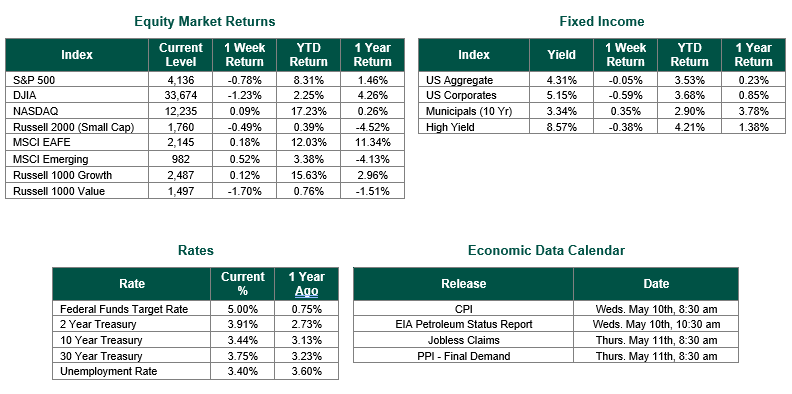

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,136, representing a loss of 0.78%, while the Russell Midcap Index moved -0.80% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.49% over the week. As developed, international equity performance and emerging markets were positive, returning 0.18% and 0.52%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.44%.

Let’s go on a hike – pun intended. As we begin our journey, we know there may be some difficulty. The path ahead is unknown, but we know that the only way we can achieve our goal is to hike up to the top of the mountain. How fast do we hike without burning out? Are the gauges and tools in our possession pointing us in the right direction? What will it look like when we get to the top, and how long will it take us to get there?

Since March 2022, Jerome Powell and the Federal Reserve Open Market Committee (FOMC) have been hiking by raising short-term interest rates. At first, their pace was a marathon, not a sprint, with a 25-basis point (o.25%) interest rate increase followed by a 50-basis point (0.50%) increase. But this tempo was not good enough, and the FOMC ultimately delivered four consecutive 75 basis point (0.75%) rate hikes to expedite their path up the mountain. These hikes would be the most aggressive actions ever taken in succession by the Federal Reserve. During this time, many economists and market participants worried that this rapid pace might cause the Fed to slip and cause a hard landing by falling down the terrain. But the landscape remained resilient, and although the FOMC would slow their hike down to 50 basis points in December of 2022, followed by two consecutive 25 basis point (0.25%) raises beginning in February of 2023, the committee pushed onward.

On Wednesday of last week, Fed Chair Jerome Powell delivered another 25-basis point (0.25%) hike. At the end of this leg, however, the committee omitted the following language that was in their statement after their meeting in March: “The Committee anticipates that some additional policy firming may be appropriate,” suggesting that perhaps they will now pause or be at the end of this rate hike cycle.

If it is true that the Fed has reached the peak of its hike, then what lies ahead? What we do know is that it certainly appears that Mr. Powell will be pausing at his peak to observe the view for some time. The Fed’s additional statement, which read, “Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation”…though “The committee remains highly attentive to inflation risks,” suggests that it is very unlikely that they will be cutting rates and heading back down the mountain anytime soon.

Without a crystal ball, we do not know what lies ahead for the Fed chairman and his committee. As it appears right now, their compass is still not perfectly aligned. After their March meeting, the Fed’s year-end inflation forecast, using PCE, moved slightly higher to 3.3%, from 3.1% – still well above their 2% target. They also lowered their year-end unemployment forecast to 4.5% from 4.6% – well above the current rate of 3.4%. And lastly, their forecast of GDP growth of just 0.4% in 2023 and 1.2% in 2024 would suggest that bad weather could be ahead on the Fed’s mountain, making for a potentially slippery slope on the way down. How the Fed navigates the rest of their hike and when they decide to make their voyage back down remains to be seen. For now, we pause while the markets continue to provide various income and growth opportunities for consideration as we look out further when the path becomes less uncertain.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 5/5/23. Economic Calendar Data from Econoday as of 5/5/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.