Last Week’s Markets in Review: Thanksgiving Day Inflation and FOMC Minutes

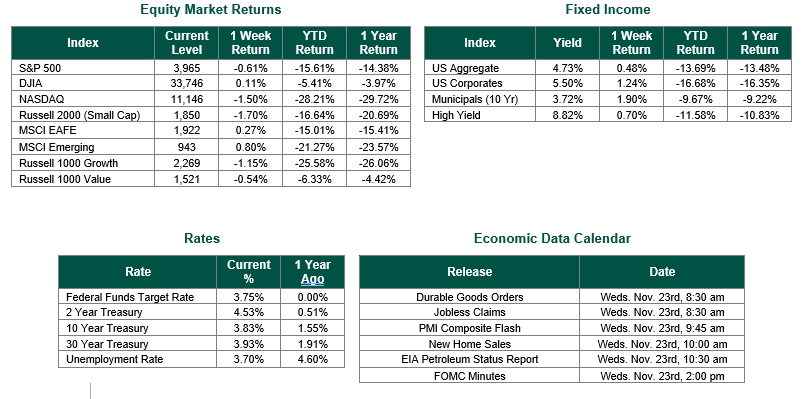

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,026, representing an increase of 2.04%, while the Russell Midcap Index moved 1.81% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.66% over the week. As developed, international equity performance and emerging markets were mixed, returning 2.16% and -0.09%, respectively. Finally, the 10-year U.S. Treasury yield fell slightly, closing the week at 3.68%.

We hope that all of our readers were able to kick back, relax, and enjoy a healthy and happy Thanksgiving holiday.

In the holiday-shortened trading week, markets were relatively stable as all market-moving data funneled in on Wednesday. Durable goods orders rebounded sharply in October as new orders came in at 1% month-over-month and above consensus expectations of 0.4%. Weekly jobless claims were reported at 240,000, above consensus estimates of 225,000. The last item on the data front was the PMI composite flash, which is the early estimate of current private sector output. PMI declined to 46.3 from 48.2 and below expectations of 50, representing a contraction in business activity.

The reported data was a welcoming sign for a Federal Reserve that has fought aggressively to cool the U.S. economy throughout 2022. Importantly, minutes from the Federal Open Market Committee’s (FOMC) November meeting were released later in the day on Wednesday and suggested that the Fed expects to move towards lower rate hikes “soon.” If “soon” for the Fed means December, it would solidify the speculation that we have reached peak hawkishness in monetary policy.

Experiencing peak monetary hawkishness and lower inflation would be a favorable sign for Americans, as we have all felt the brunt of rising prices throughout this year. According to the American Farm Bureau Federation, the cost of Thanksgiving dinner in 2022 will have averaged approximately a 20% increase over last year. The cost of a 16-pound turkey increased by 21%, boxed stuffing by 69%, and pie crust by 26%, to name a few items that were likely on the Holiday table. If the decisions by the Fed can be effective, perhaps 2023 will be an easier year for American’s pocketbooks.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Durable Goods Orders from the U.S. Department of Commerce. PMI data from S&P Global. Weekly Jobless Claims were sourced from the Department of Labor. Equity Market and Fixed Income returns are from JP Morgan as of 11/25/22. Rates and Economic Calendar Data from Bloomberg as of 11/25/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.