Last Week’s Markets in Review: The Consumer this Holiday Shopping Season

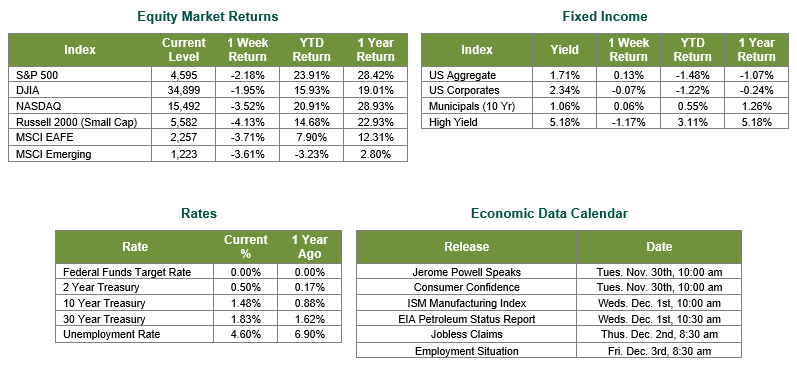

Last week, global equities moved lower across the board as markets plummeted, and volatility spiked on Friday with concerns over a new wave of COVID cases and the new Omicron variant. While today is starting off with “Buy the Dip” tones, we will closely monitor the new variant’s spread as well as health and economic impacts. The S&P 500 closed the week at a level of 4,595, representing a loss of 2.18%, while the Russell Midcap Index moved 2.5% lower. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -4.13%. International equity performance also struggled as developed and emerging markets returned -3.71% and -3.61%, respectively. Finally, the 10-year U.S. Treasury yield moved six basis points lower over the week, closing at 1.48% on Friday.

Welcome back, and we hope that everyone enjoyed the Thanksgiving Holiday. While last week’s trading session was shortened as we paused to give thanks and hopefully enjoy time with friends and family, there was an abundance of news and data releases. A few top ticket items included Federal Reserve Chairman Jerome Powell’s renomination for a second term, initial jobless claims falling below 200,000 to a pandemic-era low, and the second reading of Q3 GDP in line with forecasts at 2.1%.

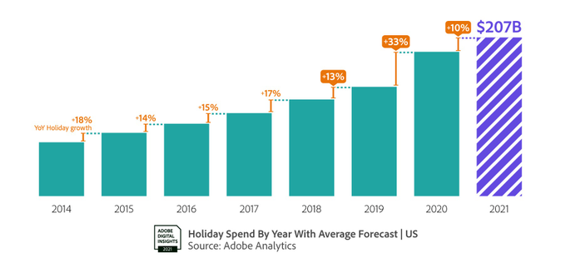

This week’s update will focus on the holiday shopping tradition and the U.S. consumer. Today marks Cyber Monday, a critical cog in the holiday shopping machine along with its age-old partner, Black Friday. While Black Friday dates back to the 1950s, the term Cyber Monday was coined in 2005 by a member of the National Retail Federation, and the growth in online sales since has exploded.

We have long believed in the growth potential of e-commerce, and in 2020, the onset of COVID-19 has accelerated its adoption across the globe. This year’s holiday shopping season will likely show the continued sales growth in online shopping and the strength of the consumer. Consider the following from Adobe Analytics:

• Expects a record $207 billion spent online this holiday shopping season in the U.S. and $910 billion globally

• Forecasts over $4 Trillion to be spent online globally in all of 2021 — a new milestone for e-commerce.

• On average, a consumer in the U.S. will spend 12 full hours shopping online this holiday season. In the peak hour of Cyber Monday (5-6 pm ET), consumers will spend over $12 million every minute.

As we marvel at the data and continued growth of e-commerce, remember the consumer makes it all possible, given that consumer spending accounts for approximately 70% of Gross Domestic Product (GDP) in the United States. Earlier this month, we saw retail sales top expectations and increase the most since March. Last week’s data releases showed that personal income and spending surprised the upside and are looking to reaccelerate in the year’s final three months. On the other hand, the University of Michigan Consumer Sentiment Index exceeded expectations. However, it remains relatively low, with inflation concerns as the primary culprit. However, there are additional metrics that point to the overall strong position of the U.S. consumer. Household debt-to-disposable income levels are at some of the lowest levels seen this century, and personal savings are abundant. In addition, the labor market recovery and continued pent-up demand in certain industries will likely provide support to consumption to and through the holiday season.

From an investment standpoint, consider the wide range of potential beneficiaries of this online phenomenon. Of course, there are the companies that sell goods almost exclusively online and the traditional brick-and-mortar companies that have expanded their online presence. However, investors may also want to consider the full cycle of electronically buying and selling goods and services, which we believe comprise the entire “E-Commerce ecosystem.” For example, the companies that develop hardware and software to enable the online communities, the internet service providers, payment processors, delivery agents, and even warehouses are all primary benefactors of the e-commerce wave.

As always, we encourage investors to work with experienced financial professionals to help navigate the capital markets and build and manage the asset allocations within their portfolio strategies consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 11/26/21. Rates and Economic Calendar Data from Bloomberg as of 11/26/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.