Last Week’s Markets in Review: The Factors That May Impact Economic Growth in 2021

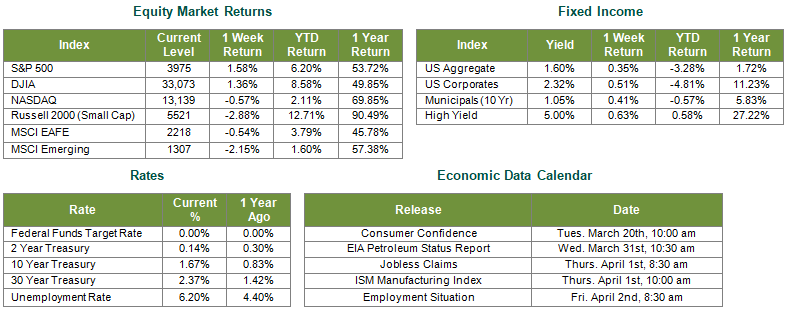

Global equity markets were mixed on the week, with U.S. equities leading international equities. In the U.S., the S&P 500 Index rose to a level of 3,975, representing a 1.58% gain, while the Russell Midcap Index followed suit, appreciating 0.16%. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, moved 2.88% lower over the week. Moreover, developed and emerging international markets fell 0.54% and 2.15%, respectively. Finally, the 10-year U.S. Treasury moved to 1.67%, seven basis points lower than the prior week.

For those of us actively involved in analyzing and accessing macro-economic trends, we often assume that the concept of the expansionary phase of the economic cycle following the recessionary phase is common knowledge. However, in reality, it most certainly is not. Regular readers of our updates will know that of late, we’ve written extensively about our belief that the U.S. economy will expand at an accelerated pace in 2021, growing more than 6% by some estimates. So, with the recently released third revision of 2020 4th quarter gross domestic product (GDP) signaling an unexpected increase of 4.3%, compared to expectations for growth of 4.1%, we thought it would be helpful to lay out some of the factors that we believe will serve as potential headwinds and some that may serve as potential tailwinds to above-average growth in 2021.

Potential Tailwinds to Economic Growth:

• Reopening: Consumption, or consumer spending, makes up roughly 70% of GDP. Easy-to-use E-commerce platforms made it possible for consumers to continue to spend during the worst of the lockdown measures, which translated to relatively strong consumption results even throughout the relatively short, yet severe, recessionary period in 2020. One area that has yet to regain solid footing is the services component of GDP. As continued vaccination efforts lead to further economic reopening, a rebound in services should serve as a tailwind to economic growth.

• Fiscal Support: U.S. legislators recently passed a massive $1.9 trillion stimulus bill and have already begun talks around an additional $3 trillion infrastructure package. Government spending of this magnitude should serve as a shot in the arm for U.S. GDP in the short term.

• Pent-up Savings: Part of the previously mentioned $1.9 trillion stimulus bill was earmarked for direct payments to many Americans. While many of these direct payments went to individuals who desperately needed the relief, data shows that America’s aggregate savings rate is at the highest level in years. Aggregate savings should move closer to pre-pandemic averages as American’s take above-average cash balances and put them to work in the real economy.

• “Loose” Financial Conditions: The Federal Reserve has committed to maintaining “loose” financial conditions by keeping overnight lending rates near the 0% lower bound into 2023. Preserving record low interest rates should continue to boost lending and housing market activity.

Potentials Headwinds to Economic Growth:

• Unexpected Tightening of Financial Conditions: Although the Federal Reserve has continually reiterated that they will maintain record low interest rates for the foreseeable future, some speculate that a sustained increase in inflation may force the Federal Reserve’s hand in raising interest rates sooner than expected. Substantially higher interest rates would most likely weigh on lending activity and slow down economic growth in the process.

• Higher Taxes: With so many trillions of dollars in fiscal packages being discussed, it’s only natural to assume that a future tax hike is coming in one form or another. At present, the White House and certain Congressional members have discussed increasing corporate taxes to 25% and raising the highest individual tax bracket to 39.6%. If implemented, these changes would have an immediate impact on economic growth

• The Forbearance Cliff: Many of the loan forgiveness programs established to assist borrowers during the worst of the recession are set to expire. Any lingering fragility amongst borrowers may be amplified when insolvent debtors are once again required to make loan payments in a timely fashion.

• International Trade: The U.S. Dollar has depreciated against most major currencies for the last year, but, by some estimates, the U.S. Dollar remains overvalued and has further room to fall. An overvalued U.S. dollar typically results in more imports and fewer exports, which can become problematic as increased imports detract from GDP growth. In contrast, increased exports often contribute to GDP growth.

To be clear, we do believe that 2021 will mark one of the most robust years for economic growth in decades, but its all relative, and we also recognize that when it comes to investing, having a firm grasp on both sides of an argument often leads to better investment decisions and often better outcomes. For this reason, we believe that investors should be actively discussing potential headwinds and tailwinds to economic growth with their financial professionals. Furthermore, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, time-frame, and risk tolerance.

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 3/26/21. Rates and Economic Calendar Data from Bloomberg as of 3/26/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.