Last Week’s Markets in Review: The Fed Pivots and the Markets React

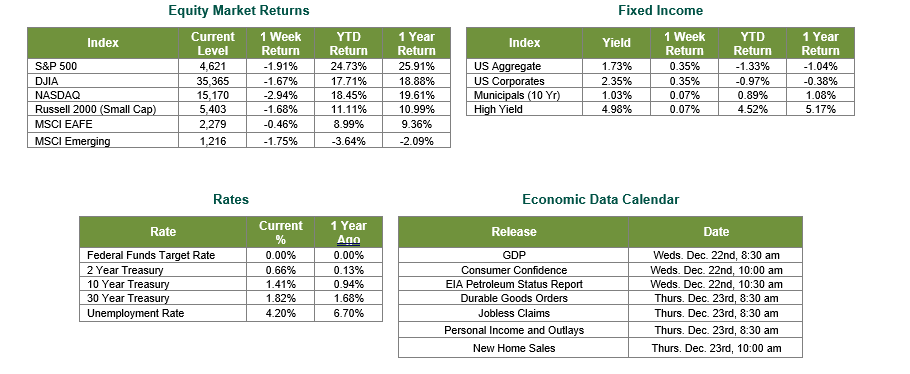

Last week, global equities moved lower across the board. The S&P 500 closed the week at a level of 4,621, representing a loss of 1.91%, while the Russell Midcap Index moved 1.61% lower. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.68%. International equity performance also struggled as developed and emerging markets returned -0.46% and -1.75%, respectively. Finally, the 10-year U.S. Treasury yield moved seven basis points lower over the week, closing at 1.41% on Friday.

Last week the spotlight was on the December meeting of the Federal Open Market Committee (“FOMC”). The Federal Reserve (“Fed”) undoubtedly acknowledged the presence of inflation and inflationary pressures, made evident from this month’s CPI and PPI readings and likely to be reinforced by the PCE deflator release later this week. In turn, as largely expected, the Fed announced that they will now be increasing the pace of tapering from what was previously announced last month. Somewhat of a surprise, however, was the number of potential interest rate hikes next year. Remember that these updates relate to the Fed’s overall “TNT” (Taper-Narrow-Tighten) approach to handling inflation, promoting full employment, and helping the economy fully recover from the COVID-19 pandemic. In summary:

• The Fed will double the pace of tapering from a reduction of $15 billion of bond purchases per month to a reduction of $30 billion of bond purchases per month

• The Fed’s updated “Dot Plot” chart shows the median forecast of FOMC voting members projecting:

o 3 rate hikes of 25 Bp each next year (the prior “Dot Plot” chart projected just one)

o another 3 rate hikes of 25 Bp each in 2023

o 2 additional rate hikes of 25 Bp each in 2024

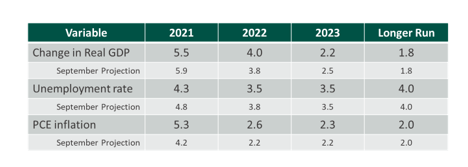

In addition to the news on tapering and the potential interest rate trajectory ahead, material changes were made to the “Summary of Economic Projections” since they were last updated in September. As you can see in the table below, the committee anticipates the lower than expected gross domestic product (“GDP”) growth this year being pushed into 2022 before moving closer to longer-run averages in 2023. In addition, they have further distanced themselves from the earlier “transitory” comments as reflected in their revised inflation expectations. Finally, the employment picture strengthens as the 3.5% updated forecast represents the 50-year low that was reached just before the onset of the COVID-19 pandemic in March 2020.

Following the announcements, equity markets appeared to applaud the Fed’s decision to help combat inflation and perhaps anticipating that their actions wouldn’t disrupt economic growth. To this end, stocks across 10 of the 11 GICS sectors (energy the exception) finished in positive territory. Interestingly enough, the technology sector led the rally, despite current high valuations and the often-cited historical impact of higher interest rates on the valuations of growth-oriented stocks. However, the initial reaction would prove short-lived as technology stocks tumbled the following day and the more cyclical areas of the economy moved higher.

Overall, macro conditions and company fundamentals remain supportive and we see continued appreciation potential for stocks moving into the new year, albeit to a lesser extent compared to the annual returns over the past three years. We encourage investors to work with experienced financial professionals to help navigate the capital markets and build and manage the asset allocations within their portfolio strategies consistent with their objectives, timeframe, and tolerance for risk. Happy Holidays, and best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 12/17/21. Rates and Economic Calendar Data from Bloomberg as of 12/17/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.