Last Week’s Markets in Review: The Future is Now

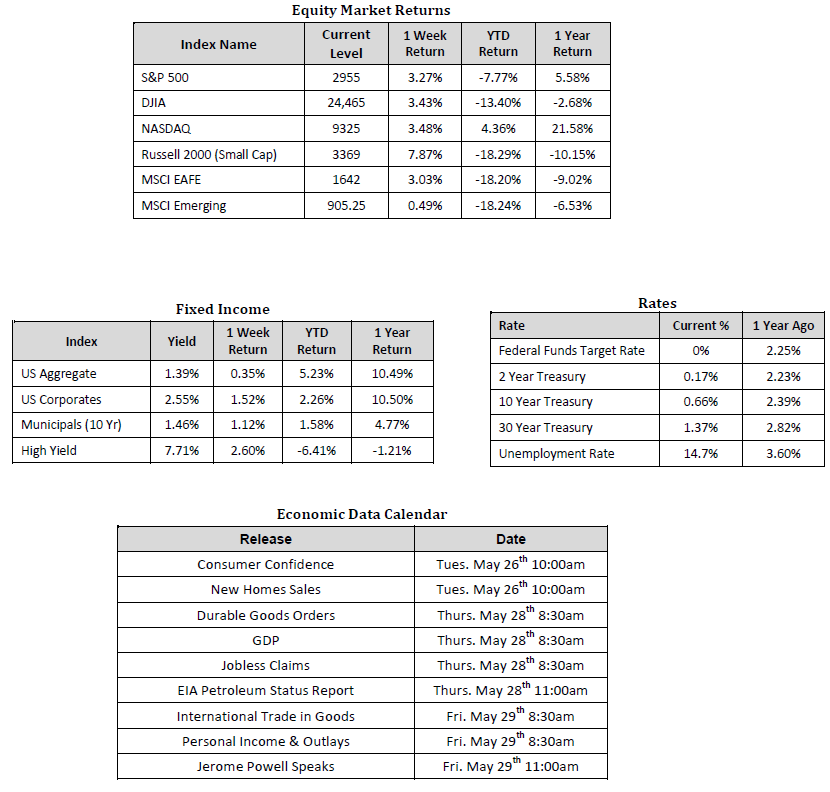

Markets continued to grind higher last week, as positive news related to COVID-19 infection rates in newly reopened states showed a promising trend. Meanwhile, housing market activity proved to be more robust than most had forecast. In the U.S., the S&P 500 Index propelled to a level of 2,955, representing a gain of 3.27%, while the Russell Midcap Index pushed 2.72% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 7.87% over the week. Moreover, developed and emerging international markets returned 3.03% and 0.49%, respectively. Finally, the yield on the 10-year U.S. Treasury rose modestly, finishing the week at 0.66%.

The spread of COVID-19 has taken the globe by storm and left unprecedented damage in its wake. Given the scope of the damage caused, it’s only natural that COVID-19 has taken center stage in informing and influencing many of our decisions. In fact, during these highly unusual times, we’ve all become accustomed to doing things that are new and untested in some cases. Each of us is now accomplishing the same old mundane daily tasks but in new and unfamiliar ways. Whether it be shopping for groceries, interacting and collaborating with colleagues, exercising, or even visiting the doctor, the world is precisely the same, yet becoming increasingly different.

We can see this economic and societal paradigm shift playing out right before our eyes at a rapidly accelerated pace, and the charge is being led by companies like Amazon, PayPal, Square, Peloton, and Netflix. Consider that in April, according to Adobe Analytics, U.S. E-commerce sales and U.S. online grocery sales saw a 49% and 110% increase in daily transactions, respectively. Moreover, goods purchased online and ultimately picked up in the store increased by 208% in April on a year-over-year basis. Even a company like Facebook, that’s been historically perceived as a social-networking site used for staying in touch with friends and relatives, recently announced the creation of a new online grant platform for small businesses. Let’s also not forget the vital role that companies like PayPal and Square have played of late in distributing Paycheck Protection Program(PPP) loans to American enterprises desperately awaiting relief, in addition to their on-going roles within the E-commerce ecosystem.

Naturally, some will revert to their pre-COVID consumer habits, but we believe that the majority will continue to embrace technological solutions like those offered by the companies mentioned above. It may not be tomorrow, but in time COVID-19 will lose prominence as a consideration, and the world will return to some semblance of normalcy, as it has done after every major catastrophe of the last 100 years. What will not return to “normal” is the degree to which we rely on digital solutions for analog chores like shopping, exercising, and working, to name a few. So while COVID-19 may gradually dim from our collective memory, the technological advancements that so many of us have come to adopt will continue to play an increasingly important role in our day-to-day lives and likely shape society for years to come. A technological revolution is well underway, and it’s being stewarded by the likes of Amazon, PayPal, Square, Peloton, and Netflix. The future is now.

Just because we believe these companies, and other similar companies, will continue to benefit and lead in the new American economy, doesn’t mean they should necessarily comprise the bulk of an investor’s portfolio. The corporations we’re referring to are expected to experience the best growth prospects over the next decade, and when a company’s outlook for long-term growth increases, so does share price volatility. In other words, more potential reward generally translates to more inherent risk. This isn’t to say that these names are entirely off-limits to risk-averse investors because overall portfolio risk can be reduced by allocating to less volatile asset classes like fixed income, all while maintaining exposure to riskier equities. This is another reason why we continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, timeframe, and tolerance for risk.

We hope everyone enjoyed a nice Memorial Day weekend and wish continued health and safety to all in the weeks ahead.

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 05/22/2020. Rates and Economic Calendar Data from Bloomberg as of 05/22/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.