Last Week’s Markets in Review: Time to Consider International Equities?

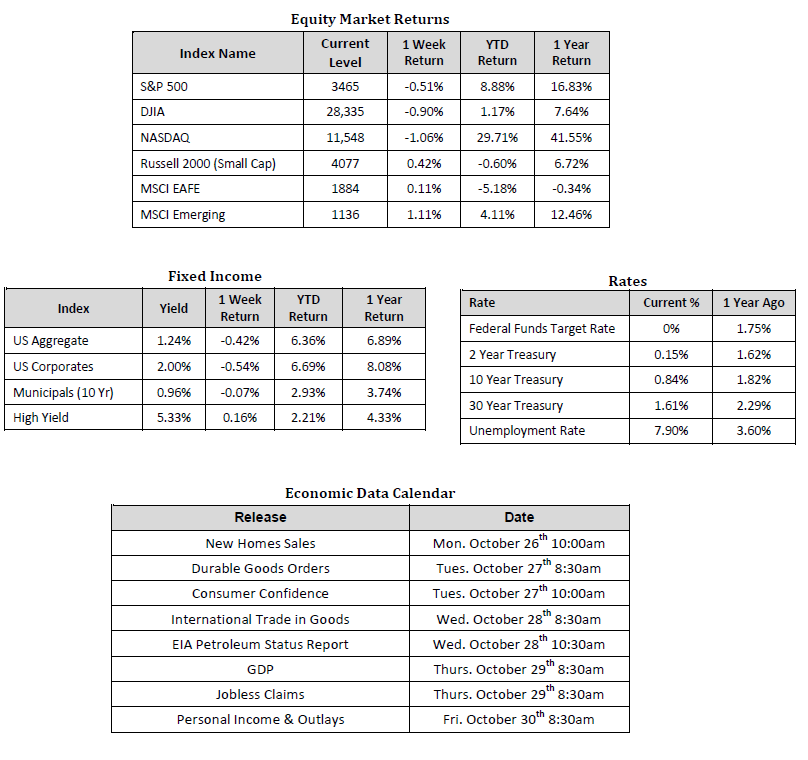

Global equity markets were mixed on the week, with emerging market equities moving higher and U.S. equities mostly moving lower. In the U.S., the S&P 500 Index fell to a level of 3,465, representing a loss of 0.51%, while the Russell Midcap Index pushed 0.47% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.42% over the week. Moreover, developed and emerging international markets returned 0.11% and 1.11%, respectively. Finally, the 10-year U.S. Treasury rose to 0.84%, seven basis points higher than the prior week.

With Election Day in the U.S. right around the corner and U.S. equity market volatility likely to remain at elevated levels for potentially weeks after, many investors are beginning to consider whether they should abandon, or reduce, U.S. equities in favor of their international counterparts. As regular readers will know, we are proponents of diversification and asset allocation based on each individual’s unique risk tolerance and objectives. As such, it would be highly unlikely that we would recommend abandoning one market for another but would instead likely suggest measured and balanced increases to select geographies while still maintaining adequate exposure to less-favored geographic markets. Managing one’s investment portfolio in this manner should help mitigate the losses that can potentially result from acting on a faulty forecast. With this axiom in mind, the question remains, should investors consider increasing exposure to developed international markets?

Before answering this timely question, let’s first consider the member countries that comprise the developed international equity index, also referred to as the MSCI EAFE Index. Japan accounts for roughly 25% of the index, the United Kingdom accounts for another 14%, and the remainder is spread amongst European Union members like France and Germany. With this being the case, it’s fair to say that as goes the European Union, so goes developed international equities. In other words, it’s unlikely that developed international equities will perform well unless European Union members also perform well.

If COVID-19 has taught us anything about how to best handle an economic crisis, it taught us that government regulators’ coordinated use of monetary and fiscal stimulus could have a significantly positive impact on staving off sustained and prolonged financial hardship. For evidence, compare the nearly four-year long recovery following the Great Depression of 1929 to the rapid recovery following the Coronacrisis. Of course, we have a long way to go before fully recovering to pre-pandemic levels, but at least for now, it appears that the worst of the economic damage may be behind us.

The longstanding knock against the European Union has been their reliance on monetary policy and their inability to deploy fiscal stimulus. In the past, the only way they’ve been able to influence markets and economies has been to lower overnight lending rates or purchase sovereign debt of member states to influence other segments of the yield curve, with the end goal of easing lending standards and encouraging borrowing and commerce. These actions are similar to those taken by our Federal Reserve, but as our Federal Reserve has noted, this form of stimulus has increasingly diminishing returns. In other words, you can only encourage borrowing by lowering rates so many times before debt starts to come to market with negative nominal yields, ultimately distorting price discovery and potentially having the opposite effect of discouraging borrowing.

Where the Federal Reserve could count on Congressional leaders for fiscal stimulus support, either by way of a tax cut, infrastructure project, more government hiring, or sending money directly to American households, the E.U. only had monetary tools at their disposal. With the usefulness of E.U. monetary stimulus at its end, the E.U. was forced to convene a fiscal authority to appropriately respond to the economic threat posed by COVID-19, which left some investors to speculate that the major structural impediments that had plagued the E.U. in the past may no longer exist, potentially warranting increased exposure to said markets.

While we acknowledge the significance of creating the European Union’s first fiscal authority, we question the sustainability and endurance of this fiscal authority and its viability in confronting the next economic disruption. The European Union is comprised of countries that have competing sovereign interests, speak various languages, have distinctive cultures, and follow vastly different economic philosophies. COVID-19 remains a crisis that is impacting every country in the world. As such, it made it easy for E.U. members to put aside stark differences and coalesce around a unanimous goal of eradicating COVID-19 and ensuring that citizens felt as little economic pain as possible. We suspect that we won’t see the same degree of unanimity and altruism next time one, or a handful, of E.U. members fall into financial disarray. In this hypothetical, future scenario, a failure of all E.U. member countries to agree on where fiscal stimulus should be deployed could once again lead to sole reliance on monetary policy and a failure to raise the fiscal funds necessary.

So, while it may appear that a significant structural impediment to the E.U.’s ability to respond to economic crisis appropriately has been removed, we’re still not sure that it will have the longevity necessary to confront the next economic meltdown. For this reason, in addition to several others, we continue to favor U.S. equities against all other global equities and do not believe it appropriate to abandon or underweight U.S. equities for developed international equities in light of elevated forward-looking volatility. Nonetheless, with heightened U.S. equity market volatility likely to sustain for the next month or two, we continue to encourage investors to consider the potential benefits of global diversification, stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles consistent with their objectives, timeframe, and tolerance for risk.

We recognize that these are very troubling and uncertain times, and we want you to know that we are always here to help in any way we can. Please stay safe and stay well.

Other Data Sources: Equity Market and Fixed Income returns are from JP Morgan as of 10/23/20. Rates and Economic Calendar Data from Bloomberg as of 10/23/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology. S&P 500 sector performance represents total return figures sourced from Bloomberg.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.