Last Week’s Markets in Review: Top Heavy Indices Push Higher

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,282, representing an increase of 3.22%, while the Russell Midcap Index moved 3.01% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 4.40% over the week. As developed, international equity performance and emerging markets were also higher, returning 0.90% and 1.26%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.69%.

Last week’s shortened holiday trading sessions did not have the significant economic data releases we have been accustomed to receiving over the past few weeks. Instead, markets moved on Washington politicians working to avoid the country’s first-ever default and a positive job market report. The employment report for May included a significant 339,000 nonfarm payroll gain compared to the expected 190,000 Dow Jones estimate. As a result, the S&P 500 would continue a stretch of three consecutive positive trading weeks, while the technology-laden Nasdaq Composite Index would produce its 6th straight positive weekly trend. Of course, all of this positive news could potentially lead the Federal Reserve to consider one more rate hike of 25 Bp (0.25%) following their upcoming meeting in June.

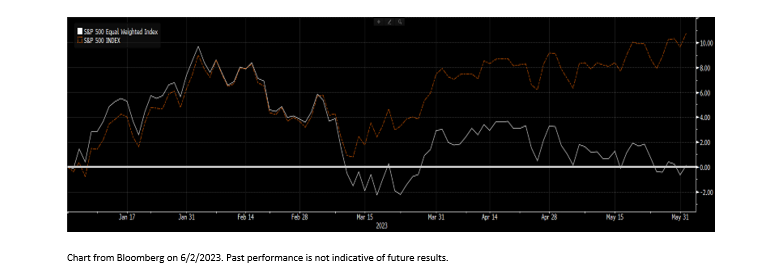

As of the end of May, the S&P 500 has had 103 trading days. Of those days, 53 have been positive, while 50 have been negative, with 22 of those days having a positive return greater than 1%. The index was up 9.65% in the year’s first five months. These data points seem like strong positives for the market, but the picture beneath the aggregate figures tells a different story.

The S&P 500 index, along with many other indices like the Nasdaq Composite and the Wilshire 5000, are market cap weighted, meaning that the largest companies within the index will hold a larger weighting and will, in return, provide a larger respective contribution to risk and return. Mega-Cap names within the market have had a very strong performance to start the year and therefore have had a significant influence on the 9.65% return of the S&P. Seven big names (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla, and Alphabet) have been responsible for 9.91% of the return contribution, meaning that without them the index would be negative for the year! This remarkable performance data could strongly influence how the index performs over the rest of 2023.

The remainder of the index is trading exactly how you would expect it to, given the continued high inflation levels, record-setting aggressiveness from the Federal Reserve, and the constant threat of a slowing economy, amongst many other headwinds. As a result, more companies within the index traded negative than positive. These facts could convince the market to continue pushing higher, despite its strong performance thus far in 2023, as many companies have not had much or any growth. As investors become more confident, companies outside of the previously mentioned mega-cap names could be able to provide positive returns.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 6/2/23. Economic Calendar Data from Econoday as of 6/2/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.