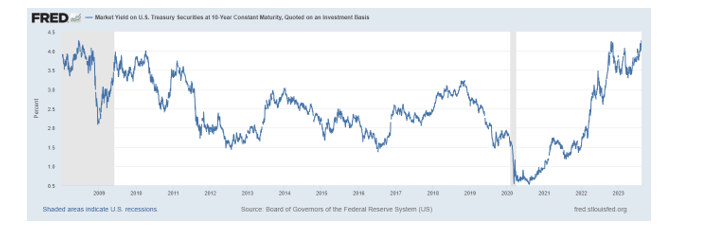

Last Week’s Markets in Review: Treasuries Rise to 15-Year High

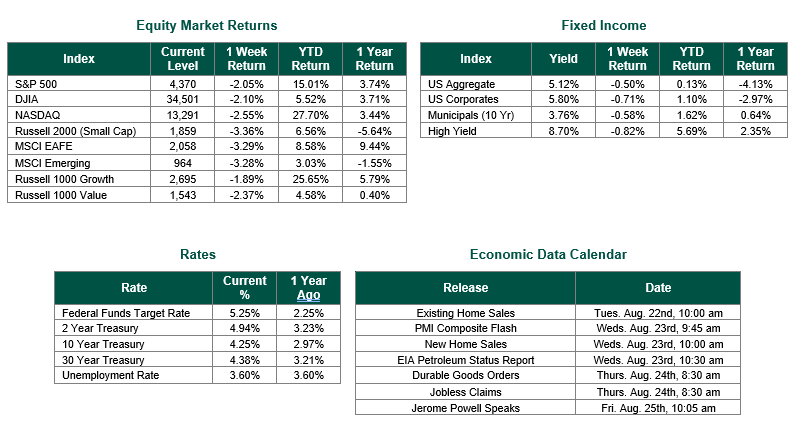

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,370, representing an decrease of 2.05%, while the Russell Midcap Index moved 2.76% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -3.36% over the week. As developed international equity performance and emerging markets were also lower, returning -3.29% and -3.28%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.25%.

Investors concerns over the state of the economy and the outlook on interest rates pushed the 10-Year Treasury bond to its highest level in 15 years last week, reaching a yield of 4.28%. Minutes from the Federal Reserves most recent meeting indicated that the possibility of future rate hikes still exists as inflation remains higher than what policy makers would like to see. However, since the minutes release, the probability of an additional rate hike at the September decision date only slightly increased from 10% to 11.5%, according to CME Group.

Despite future inflationary concerns, there have been positive developments in the inflation front, as we have mentioned in prior weeks market updates. Labor markets have shown resilience with initial jobless claims for the week of August 12th only totaling 239,000, slightly below the consensus estimate of 240,000. Additionally, retail sales figures showed an increase of 0.7% monthly, delivering the highest monthly gain since January 2023. The better-than-expected rise in retail sales and a robust labor market have investors concerned that these economic data points could give the Fed the conviction to either deliver additional rate hikes or continue to keep rates higher for longer without damaging the economy.

We hope that everyone has a productive week ahead!

Treasury yields from the Federal Reserve Bank of St. Louis on 8/18/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 8/18/23. Retail Sales data from the U.S. Bureau of the Census on 8/15/2023. Jobless Claims from the U.S. Department of Labor on 8/18/2023. Economic Calendar Data from Econoday as of 8/18/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.